Summary

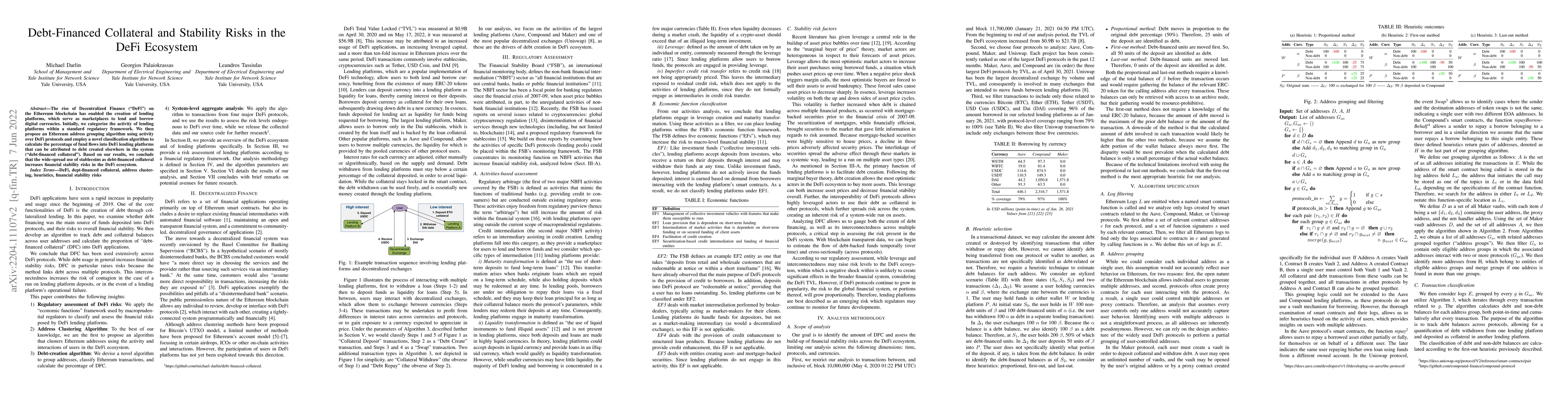

The rise of Decentralized Finance ("DeFi") on the Ethereum blockchain has enabled the creation of lending platforms, which serve as marketplaces to lend and borrow digital currencies. We first categorize the activity of lending platforms within a standard regulatory framework. We then employ a novel grouping and classification algorithm to calculate the percentage of fund flows into DeFi lending platforms that can be attributed to debt created elsewhere in the system ("debt-financed collateral"). Based on our results, we conclude that the wide-spread use of stablecoins as debt-financed collateral increases financial stability risks in the DeFi ecosystem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPerpetual Contract NFT as Collateral for DeFi Composability

Hyun-Sik Kim, Yong-Suk Park, HyoungSung Kim

| Title | Authors | Year | Actions |

|---|

Comments (0)