Summary

We study financial networks where banks are connected by debt contracts. We consider the operation of debt swapping when two creditor banks decide to exchange an incoming payment obligation, thus leading to a locally different network structure. We say that a swap is positive if it is beneficial for both of the banks involved; we can interpret this notion either with respect to the amount of assets received by the banks, or their exposure to different shocks that might hit the system. We analyze various properties of these swapping operations in financial networks. We first show that there can be no positive swap for any pair of banks in a static financial system, or when a shock hits each bank in the network proportionally. We then study worst-case shock models, when a shock of given size is distributed in the worst possible way for a specific bank. If the goal of banks is to minimize their losses in such a worst-case setting, then a positive swap can indeed exist. We analyze the effects of such a positive swap on other banks of the system, the computational complexity of finding a swap, and special cases where a swap can be found efficiently. Finally, we also present some results for more complex swapping operations when the banks swap multiple contracts, or when more than two banks participate in the swap.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

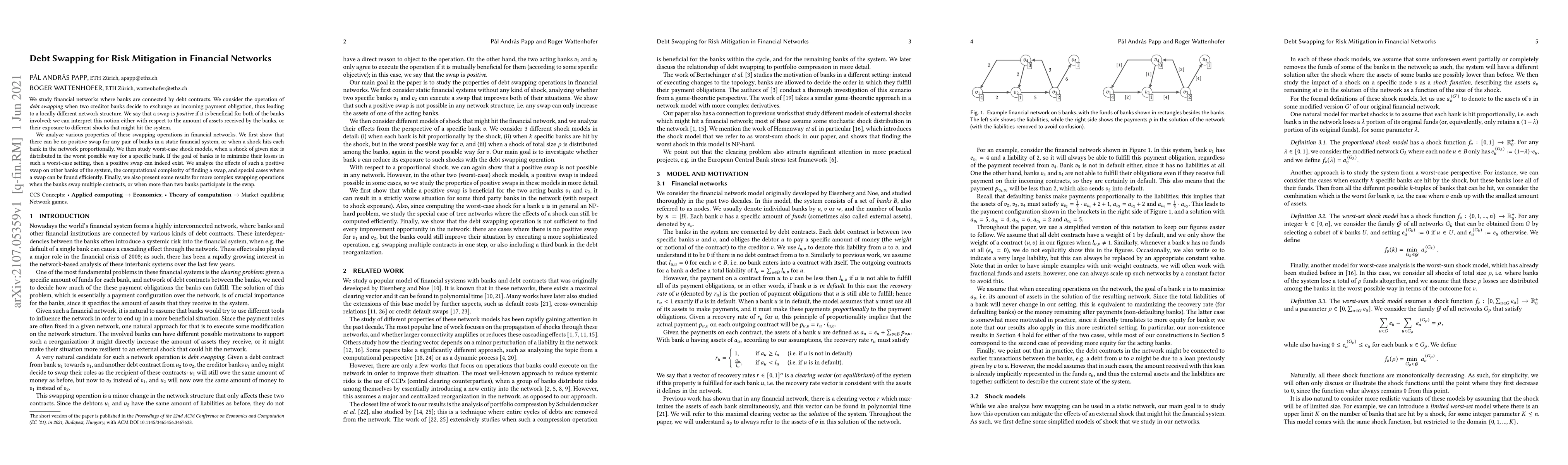

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)