Summary

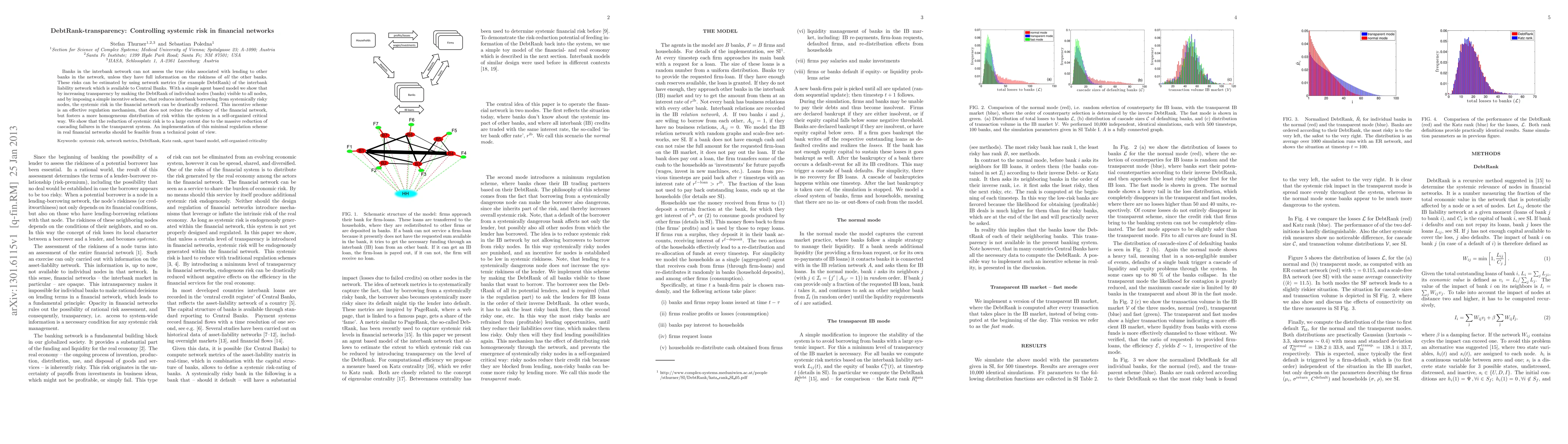

Banks in the interbank network can not assess the true risks associated with lending to other banks in the network, unless they have full information on the riskiness of all the other banks. These risks can be estimated by using network metrics (for example DebtRank) of the interbank liability network which is available to Central Banks. With a simple agent based model we show that by increasing transparency by making the DebtRank of individual nodes (banks) visible to all nodes, and by imposing a simple incentive scheme, that reduces interbank borrowing from systemically risky nodes, the systemic risk in the financial network can be drastically reduced. This incentive scheme is an effective regulation mechanism, that does not reduce the efficiency of the financial network, but fosters a more homogeneous distribution of risk within the system in a self-organized critical way. We show that the reduction of systemic risk is to a large extent due to the massive reduction of cascading failures in the transparent system. An implementation of this minimal regulation scheme in real financial networks should be feasible from a technical point of view.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGlobal Balance and Systemic Risk in Financial Correlation Networks

Fernando Diaz-Diaz, Paolo Bartesaghi, Rosanna Grassi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)