Authors

Summary

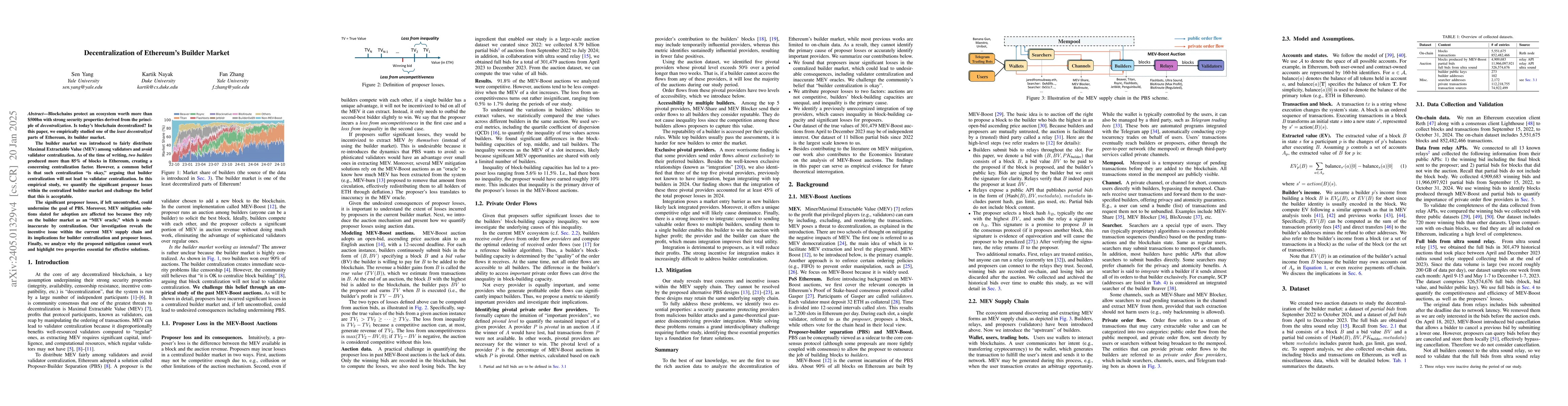

Blockchains protect an ecosystem worth more than $500bn with their strong security properties derived from the principle of decentralization. Is today's blockchain really decentralized? In this paper, we empirically studied one of the least decentralized parts of Ethereum -- the most used blockchain system in practice -- and shed light on the decentralization issue from a new perspective. To avoid centralization caused by Maximal Extractable Value (MEV), Ethereum adopts a novel mechanism that produces blocks through a builder market. After two years in operation, however, the builder market has evolved to a highly centralized one with three builders producing more than 90% of blocks. Why does the builder market centralize, given that it is permissionless and anyone can join? Moreover, what are the security implications of a centralized builder market to MEV-Boost auctions? Through a rigorous empirical study of the builder market's core mechanism, MEV-Boost auctions, we answered these two questions using a large-scale auction dataset we curated since 2022. Unlike previous works that focus on who wins the auctions, we focus on why they win, to shed light on the {openness, competitiveness, and efficiency} of MEV-Boost auctions. Our findings also help identify directions for improving the decentralization of builder markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEthereum's Proposer-Builder Separation: Promises and Realities

Roger Wattenhofer, Lioba Heimbach, Christof Ferreira Torres et al.

Private Order Flows and Builder Bidding Dynamics: The Road to Monopoly in Ethereum's Block Building Market

Yue Huang, Xuechao Wang, Jing Tang et al.

Unraveling Ethereum's Mempool: The Impact of Fee Fairness, Transaction Prioritization, and Consensus Efficiency

S M Mostaq Hossain, Amani Altarawneh

| Title | Authors | Year | Actions |

|---|

Comments (0)