Authors

Summary

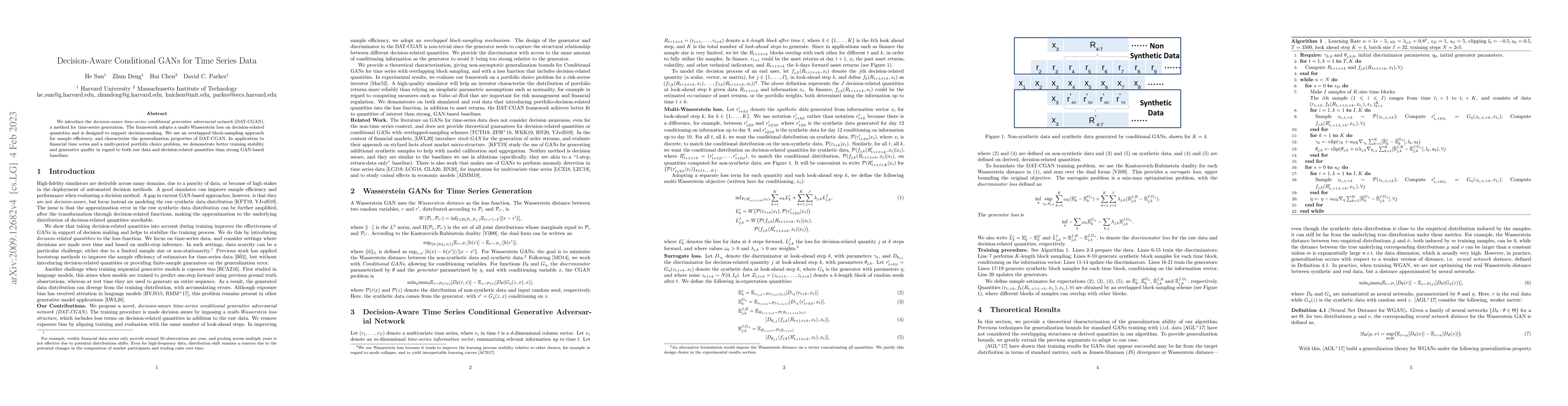

We introduce the decision-aware time-series conditional generative adversarial network (DAT-CGAN) as a method for time-series generation. The framework adopts a multi-Wasserstein loss on structured decision-related quantities, capturing the heterogeneity of decision-related data and providing new effectiveness in supporting the decision processes of end users. We improve sample efficiency through an overlapped block-sampling method, and provide a theoretical characterization of the generalization properties of DAT-CGAN. The framework is demonstrated on financial time series for a multi-time-step portfolio choice problem. We demonstrate better generative quality in regard to underlying data and different decision-related quantities than strong, GAN-based baselines.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConditional Sig-Wasserstein GANs for Time Series Generation

Hao Ni, Baoren Xiao, Lukasz Szpruch et al.

The Conditional Cauchy-Schwarz Divergence with Applications to Time-Series Data and Sequential Decision Making

Shujian Yu, Robert Jenssen, Hongming Li et al.

Channel-aware Contrastive Conditional Diffusion for Multivariate Probabilistic Time Series Forecasting

Hui Xiong, Yize Chen, Siyang Li

| Title | Authors | Year | Actions |

|---|

Comments (0)