Summary

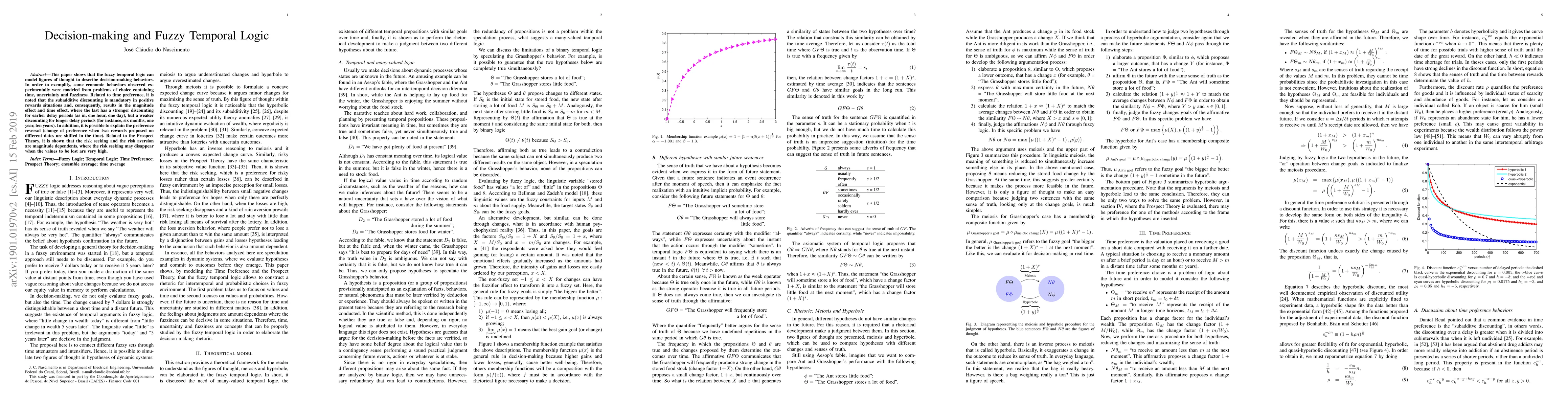

This paper shows that the fuzzy temporal logic can model figures of thought to describe decision-making behaviors. In order to exemplify, some economic behaviors observed experimentally were modeled from problems of choice containing time, uncertainty and fuzziness. Related to time preference, it is noted that the subadditive discounting is mandatory in positive rewards situations and, consequently, results in the magnitude effect and time effect, where the last has a stronger discounting for earlier delay periods (as in, one hour, one day), but a weaker discounting for longer delay periods (for instance, six months, one year, ten years). In addition, it is possible to explain the preference reversal (change of preference when two rewards proposed on different dates are shifted in the time). Related to the Prospect Theory, it is shown that the risk seeking and the risk aversion are magnitude dependents, where the risk seeking may disappear when the values to be lost are very high.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)