Summary

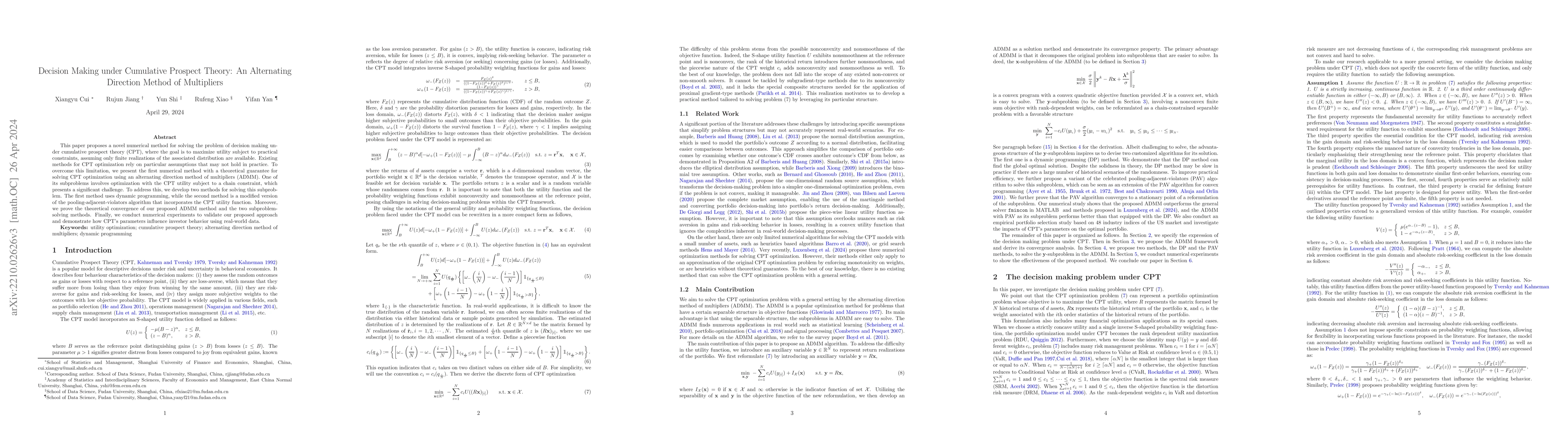

This paper proposes a novel numerical method for solving the problem of decision making under cumulative prospect theory (CPT), where the goal is to maximize utility subject to practical constraints, assuming only finite realizations of the associated distribution are available. Existing methods for CPT optimization rely on particular assumptions that may not hold in practice. To overcome this limitation, we present the first numerical method with a theoretical guarantee for solving CPT optimization using an alternating direction method of multipliers (ADMM). One of its subproblems involves optimization with the CPT utility subject to a chain constraint, which presents a significant challenge. To address this, we develop two methods for solving this subproblem. The first method uses dynamic programming, while the second method is a modified version of the pooling-adjacent-violators algorithm that incorporates the CPT utility function. Moreover, we prove the theoretical convergence of our proposed ADMM method and the two subproblem-solving methods. Finally, we conduct numerical experiments to validate our proposed approach and demonstrate how CPT's parameters influence investor behavior using real-world data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Adaptive Alternating Direction Method of Multipliers

Rubén Campoy, Hung M. Phan, Sedi Bartz

Risk-aware Markov Decision Processes Using Cumulative Prospect Theory

Krishnendu Chatterjee, Maximilian Weininger, Stefanie Mohr et al.

An Alternating Direction Method of Multipliers for Topology Optimization

Sven Leyffer, Harsh Choudhary, Dominic Yang

| Title | Authors | Year | Actions |

|---|

Comments (0)