Authors

Summary

Influence diagrams are widely employed to represent multi-stage decision problems in which each decision is a choice from a discrete set of alternatives, uncertain chance events have discrete outcomes, and prior decisions may influence the probability distributions of uncertain chance events endogenously. In this paper, we develop the Decision Programming framework which extends the applicability of influence diagrams by developing mixed-integer linear programming formulations for solving such problems in the presence of many kinds of constraints. In particular, Decision Programming makes it possible to (i) solve problems in which earlier decisions cannot necessarily be recalled later, for instance, when decisions are taken by agents who cannot communicate with each other; (ii) accommodate a broad range of deterministic and chance constraints, including those based on resource consumption, logical dependencies or risk measures such as Conditional Value-at-Risk; and (iii) determine all non-dominated decision strategies in problems which involve multiple value objectives. In project portfolio selection problems, Decision Programming allows scenario probabilities to depend endogenously on project decisions and can thus be viewed as a generalization of Contingent Portfolio Programming.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

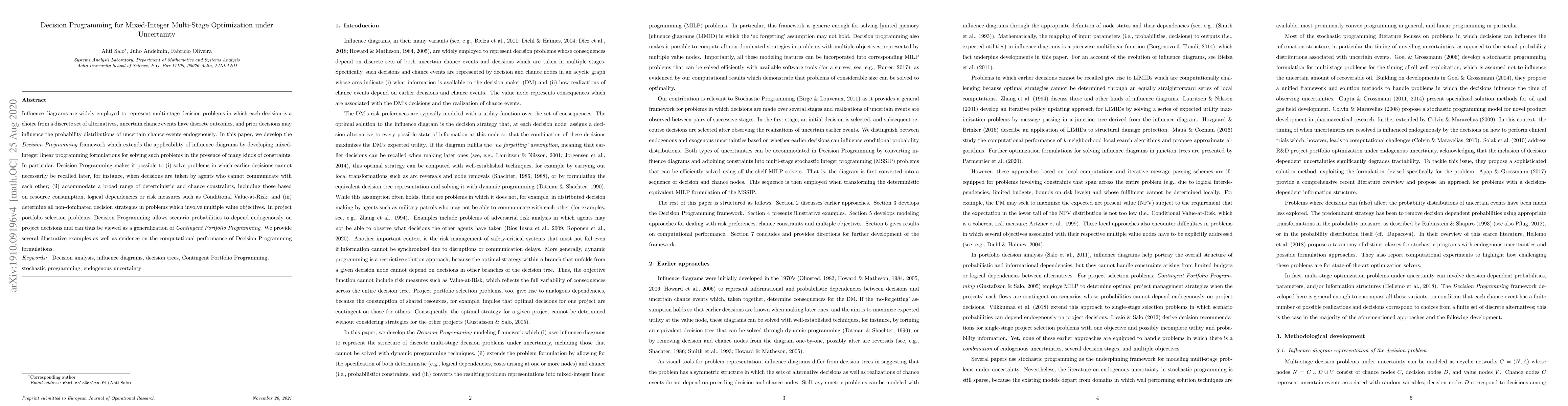

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTwo-Stage ML-Guided Decision Rules for Sequential Decision Making under Uncertainty

Pascal Van Hentenryck, Andrew Rosemberg, Alexandre Street et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)