Summary

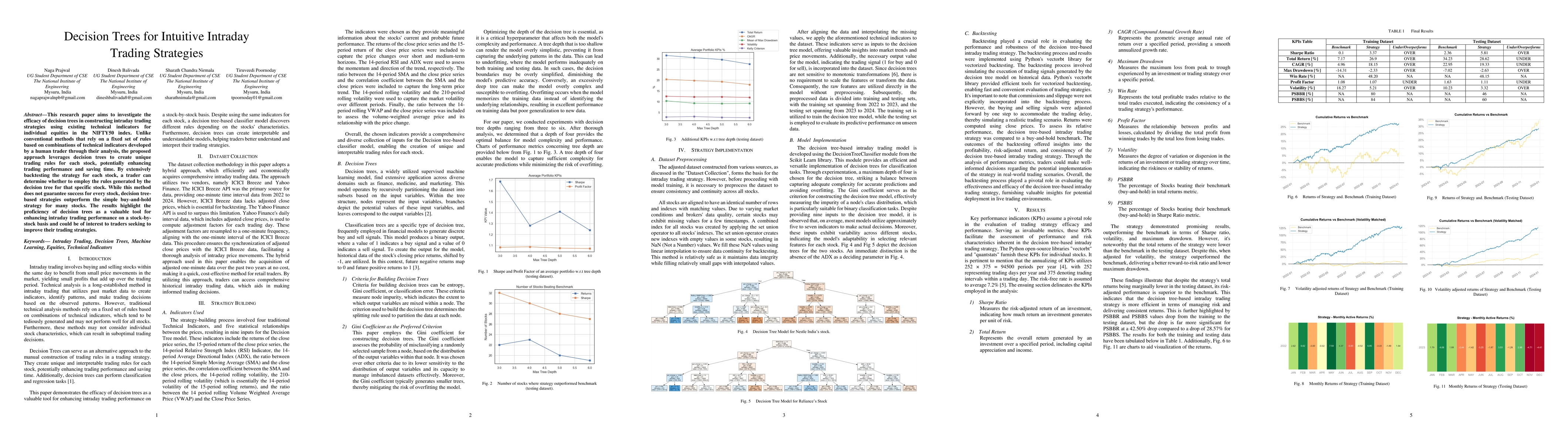

This research paper aims to investigate the efficacy of decision trees in constructing intraday trading strategies using existing technical indicators for individual equities in the NIFTY50 index. Unlike conventional methods that rely on a fixed set of rules based on combinations of technical indicators developed by a human trader through their analysis, the proposed approach leverages decision trees to create unique trading rules for each stock, potentially enhancing trading performance and saving time. By extensively backtesting the strategy for each stock, a trader can determine whether to employ the rules generated by the decision tree for that specific stock. While this method does not guarantee success for every stock, decision treebased strategies outperform the simple buy-and-hold strategy for many stocks. The results highlight the proficiency of decision trees as a valuable tool for enhancing intraday trading performance on a stock-by-stock basis and could be of interest to traders seeking to improve their trading strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep reinforcement learning with positional context for intraday trading

Sven Goluža, Tomislav Kovačević, Tessa Bauman et al.

Maximizing Battery Storage Profits via High-Frequency Intraday Trading

Thorsten Staake, Nils Löhndorf, David Wozabal et al.

No citations found for this paper.

Comments (0)