Authors

Summary

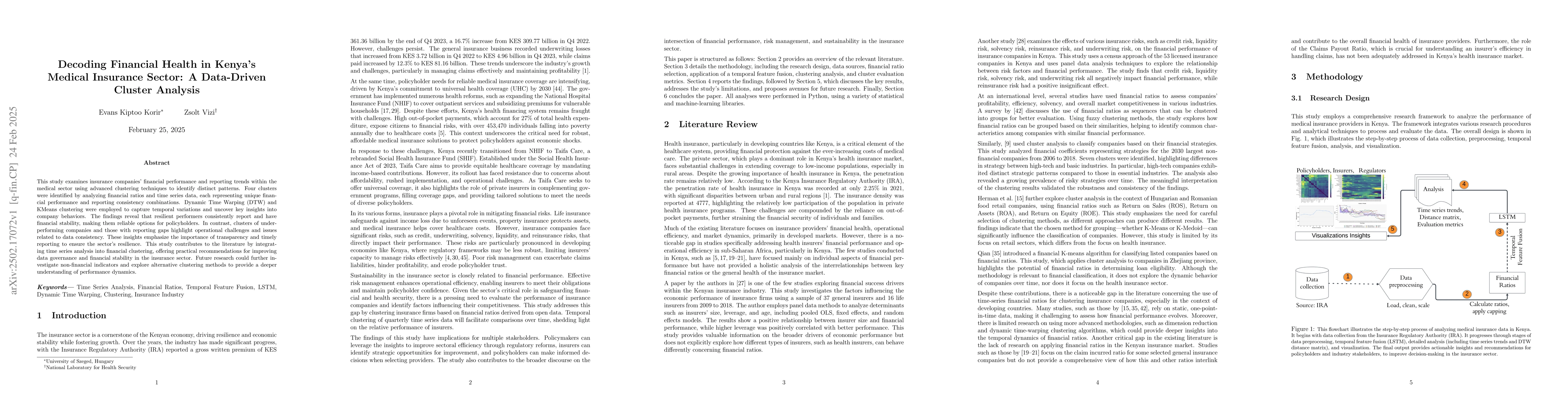

This study examines insurance companies' financial performance and reporting trends within the medical sector using advanced clustering techniques to identify distinct patterns. Four clusters were identified by analyzing financial ratios and time series data, each representing unique financial performance and reporting consistency combinations. Dynamic Time Warping (DTW) and KMeans clustering were employed to capture temporal variations and uncover key insights into company behaviors. The findings reveal that resilient performers consistently report and have financial stability, making them reliable options for policyholders. In contrast, clusters of underperforming companies and those with reporting gaps highlight operational challenges and issues related to data consistency. These insights emphasize the importance of transparency and timely reporting to ensure the sector's resilience. This study contributes to the literature by integrating time series analysis into financial clustering, offering practical recommendations for improving data governance and financial stability in the insurance sector. Future research could further investigate non-financial indicators and explore alternative clustering methods to provide a deeper understanding of performance dynamics.

AI Key Findings

Generated Jun 11, 2025

Methodology

This study employed LSTM networks for dimensionality reduction and K-Means and Hierarchical clustering for pattern identification in financial time-series data of Kenya's medical insurance sector.

Key Results

- Four distinct clusters of insurance companies were identified based on financial performance and reporting patterns.

- Clusters 1 and 2 comprise companies with relatively stable performance, with Cluster 2 demonstrating resilience despite occasional fluctuations, while Cluster 1 reflects steady improvement in later stages.

- Clusters 3 and 4 reveal irregular reporting behaviors, with data discontinuities and delayed reporting creating challenges in assessing long-term financial stability.

Significance

This research offers valuable insights into the dynamics of the insurance sector, highlighting the critical need to address data gaps and refine scaling techniques to enhance clustering accuracy.

Technical Contribution

The application of Dynamic Time Warping (DTW)-based clustering offers a novel approach to analyzing financial time-series data within the insurance sector, capturing temporal dependencies more effectively than conventional clustering methods.

Novelty

This study differentiates itself by leveraging LSTM networks for dimensionality reduction and temporal pattern extraction, providing meaningful insights from time-series financial data and aligning with previous studies emphasizing the role of time-series analysis in financial modeling.

Limitations

- The analysis excluded qualitative and non-financial factors, such as customer satisfaction or regulatory compliance, which could provide critical context.

- Reliance on common financial ratios excluded other essential measures, such as Return on Sales (ROS), Return on Assets (ROA), and Return on Equity (ROE).

Future Work

- Future research should expand the analytical scope to include non-financial metrics, such as customer satisfaction, regulatory compliance, and competitive positioning.

- Exploring advanced machine learning models like probabilistic clustering methods could reveal complementary perspectives and improve predictive accuracy.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApplication of Blockchain in Healthcare and Health Insurance Sector

Debendranath Das

Design and Financial Analysis of a Health Insurance Based on an SIH-Type Epidemic Model

Jonathan Hoseana, Felivia Kusnadi, Gracia Stephanie et al.

Systemic Risk in the European Insurance Sector

Nicola Borri, Giovanni Bonaccolto, Andrea Consiglio et al.

No citations found for this paper.

Comments (0)