Authors

Summary

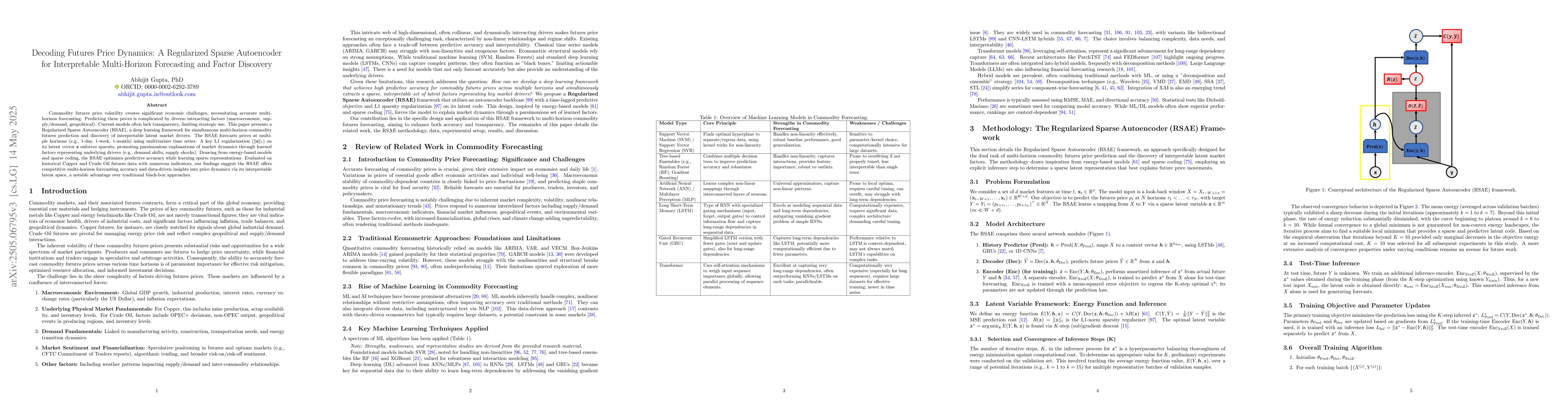

Commodity price volatility creates economic challenges, necessitating accurate multi-horizon forecasting. Predicting prices for commodities like copper and crude oil is complicated by diverse interacting factors (macroeconomic, supply/demand, geopolitical, etc.). Current models often lack transparency, limiting strategic use. This paper presents a Regularized Sparse Autoencoder (RSAE), a deep learning framework for simultaneous multi-horizon commodity price prediction and discovery of interpretable latent market drivers. The RSAE forecasts prices at multiple horizons (e.g., 1-day, 1-week, 1-month) using multivariate time series. Crucially, L1 regularization ($\|\mathbf{z}\|_1$) on its latent vector $\mathbf{z}$ enforces sparsity, promoting parsimonious explanations of market dynamics through learned factors representing underlying drivers (e.g., demand, supply shocks). Drawing from energy-based models and sparse coding, the RSAE optimizes predictive accuracy while learning sparse representations. Evaluated on historical Copper and Crude Oil data with numerous indicators, our findings indicate the RSAE offers competitive multi-horizon forecasting accuracy and data-driven insights into price dynamics via its interpretable latent space, a key advantage over traditional black-box approaches.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research introduces a Regularized Sparse Autoencoder (RSAE), a deep learning framework that uses L1 regularization to enforce sparsity in the latent vector, enabling simultaneous multi-horizon commodity price prediction and discovery of interpretable latent market drivers from multivariate time series data.

Key Results

- The RSAE offers competitive multi-horizon forecasting accuracy for commodities like copper and crude oil.

- The model provides data-driven insights into price dynamics via its interpretable latent space, highlighting underlying drivers such as demand and supply shocks.

Significance

This research is important as it addresses the economic challenges posed by commodity price volatility by providing accurate, transparent, and interpretable multi-horizon forecasts, which can aid strategic decision-making compared to traditional black-box approaches.

Technical Contribution

The primary technical contribution is the development and application of the Regularized Sparse Autoencoder (RSAE) for interpretable multi-horizon forecasting and factor discovery in commodity price dynamics.

Novelty

The RSAE stands out by combining deep learning with sparse coding principles, ensuring both predictive accuracy and interpretability of latent factors, which is a novel approach in the field of commodity price forecasting.

Limitations

- The paper does not discuss potential issues with overfitting or generalizability to unseen market conditions.

- Limited to evaluating on copper and crude oil data; further validation on other commodities is needed.

Future Work

- Explore application of RSAE on other commodity markets to assess its generalizability.

- Investigate methods to handle and incorporate a broader range of macroeconomic, supply/demand, and geopolitical factors.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-Factor Polynomial Diffusion Models and Inter-Temporal Futures Dynamics

Gareth W. Peters, Pavel V. Shevchenko, Peilun He et al.

Fast Dual-Regularized Autoencoder for Sparse Biological Data

Aleksandar Poleksic

l0-Regularized Sparse Coding-based Interpretable Network for Multi-Modal Image Fusion

Saumik Bhattacharya, Aurobinda Routray, Gargi Panda et al.

No citations found for this paper.

Comments (0)