Summary

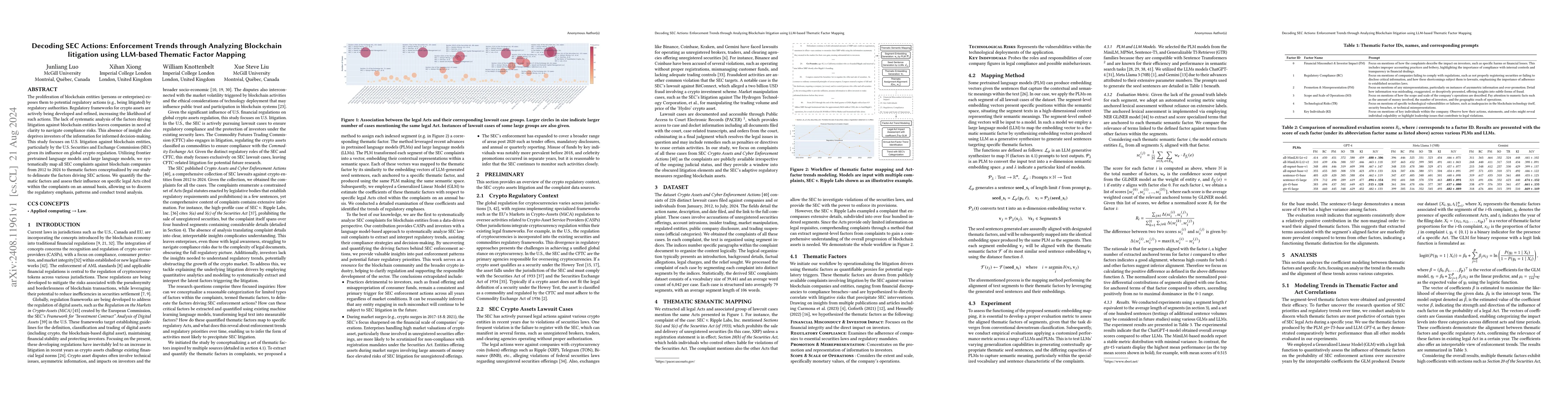

The proliferation of blockchain entities (persons or enterprises) exposes them to potential regulatory actions (e.g., being litigated) by regulatory authorities. Regulatory frameworks for crypto assets are actively being developed and refined, increasing the likelihood of such actions. The lack of systematic analysis of the factors driving litigation against blockchain entities leaves companies in need of clarity to navigate compliance risks. This absence of insight also deprives investors of the information for informed decision-making. This study focuses on U.S. litigation against blockchain entities, particularly by the U.S. Securities and Exchange Commission (SEC) given its influence on global crypto regulation. Utilizing frontier pretrained language models and large language models, we systematically map all SEC complaints against blockchain companies from 2012 to 2024 to thematic factors conceptualized by our study to delineate the factors driving SEC actions. We quantify the thematic factors and assess their influence on specific legal Acts cited within the complaints on an annual basis, allowing us to discern the regulatory emphasis, patterns and conduct trend analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLLM-Net: Democratizing LLMs-as-a-Service through Blockchain-based Expert Networks

Zan-Kai Chong, Hiroyuki Ohsaki, Bryan Ng

DeTAILS: Deep Thematic Analysis with Iterative LLM Support

James R. Wallace, Ash Sharma, Karen Cochrane

No citations found for this paper.

Comments (0)