Summary

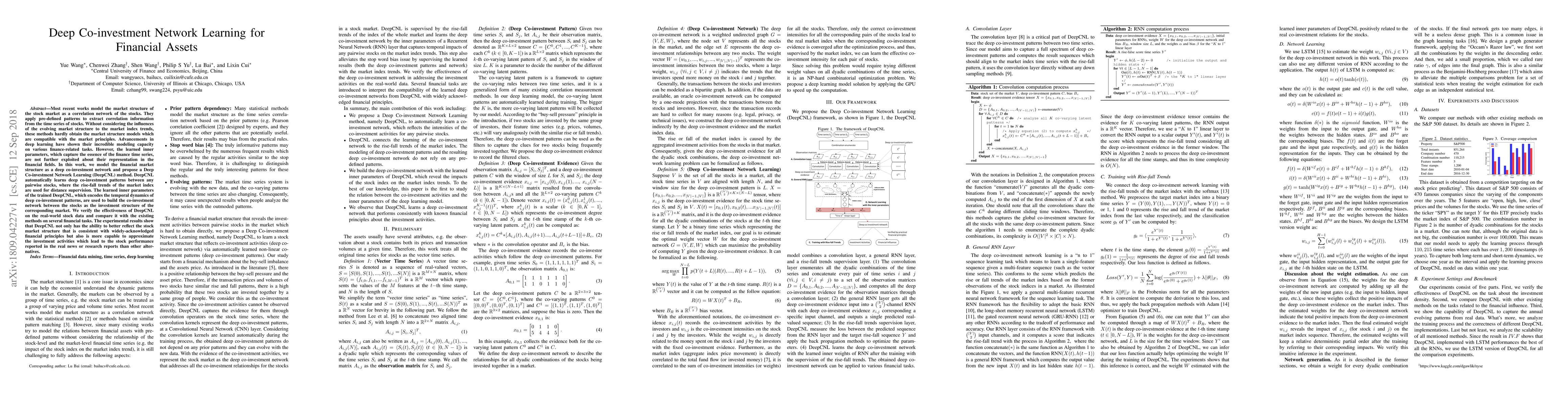

Most recent works model the market structure of the stock market as a correlation network of the stocks. They apply pre-defined patterns to extract correlation information from the time series of stocks. Without considering the influences of the evolving market structure to the market index trends, these methods hardly obtain the market structure models which are compatible with the market principles. Advancements in deep learning have shown their incredible modeling capacity on various finance-related tasks. However, the learned inner parameters, which capture the essence of the finance time series, are not further exploited about their representation in the financial fields. In this work, we model the financial market structure as a deep co-investment network and propose a Deep Co-investment Network Learning (DeepCNL) method. DeepCNL automatically learns deep co-investment patterns between any pairwise stocks, where the rise-fall trends of the market index are used for distance supervision. The learned inner parameters of the trained DeepCNL, which encodes the temporal dynamics of deep co-investment patterns, are used to build the co-investment network between the stocks as the investment structure of the corresponding market. We verify the effectiveness of DeepCNL on the real-world stock data and compare it with the existing methods on several financial tasks. The experimental results show that DeepCNL not only has the ability to better reflect the stock market structure that is consistent with widely-acknowledged financial principles but also is more capable to approximate the investment activities which lead to the stock performance reported in the real news or research reports than other alternatives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStock Embeddings: Learning Distributed Representations for Financial Assets

Rian Dolphin, Barry Smyth, Ruihai Dong

| Title | Authors | Year | Actions |

|---|

Comments (0)