Authors

Summary

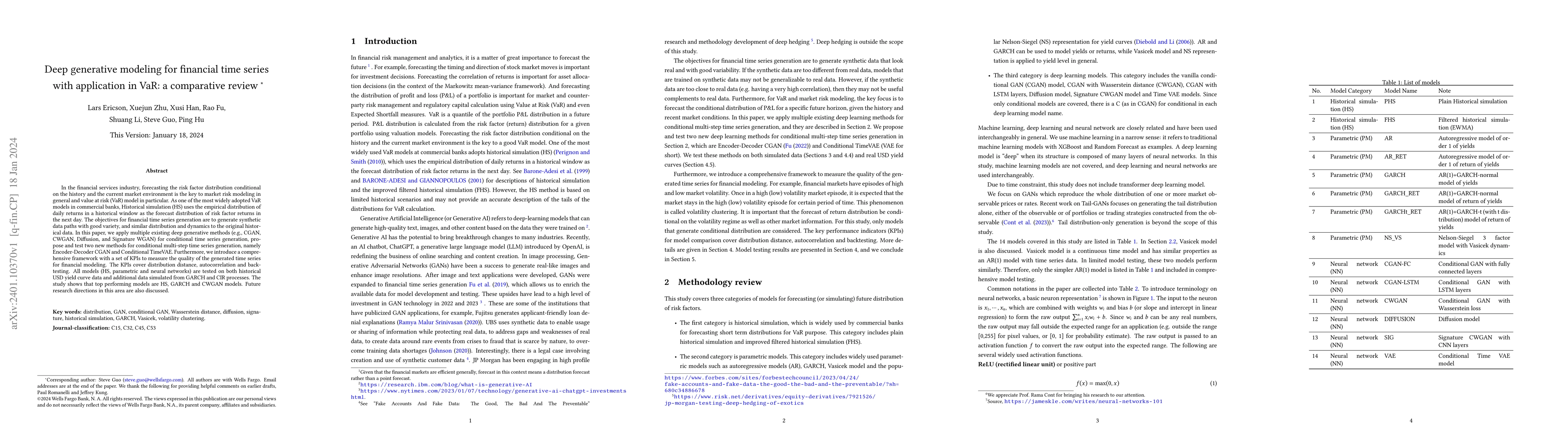

In the financial services industry, forecasting the risk factor distribution conditional on the history and the current market environment is the key to market risk modeling in general and value at risk (VaR) model in particular. As one of the most widely adopted VaR models in commercial banks, Historical simulation (HS) uses the empirical distribution of daily returns in a historical window as the forecast distribution of risk factor returns in the next day. The objectives for financial time series generation are to generate synthetic data paths with good variety, and similar distribution and dynamics to the original historical data. In this paper, we apply multiple existing deep generative methods (e.g., CGAN, CWGAN, Diffusion, and Signature WGAN) for conditional time series generation, and propose and test two new methods for conditional multi-step time series generation, namely Encoder-Decoder CGAN and Conditional TimeVAE. Furthermore, we introduce a comprehensive framework with a set of KPIs to measure the quality of the generated time series for financial modeling. The KPIs cover distribution distance, autocorrelation and backtesting. All models (HS, parametric and neural networks) are tested on both historical USD yield curve data and additional data simulated from GARCH and CIR processes. The study shows that top performing models are HS, GARCH and CWGAN models. Future research directions in this area are also discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantum generative modeling for financial time series with temporal correlations

Jordi Tura, Vedran Dunjko, Diego Garlaschelli et al.

Application of time-series quantum generative model to financial data

Shun Okumura, Masayuki Ohzeki, Masaya Abe

Generative model for financial time series trained with MMD using a signature kernel

Julian Sester, Chung I Lu

| Title | Authors | Year | Actions |

|---|

Comments (0)