Summary

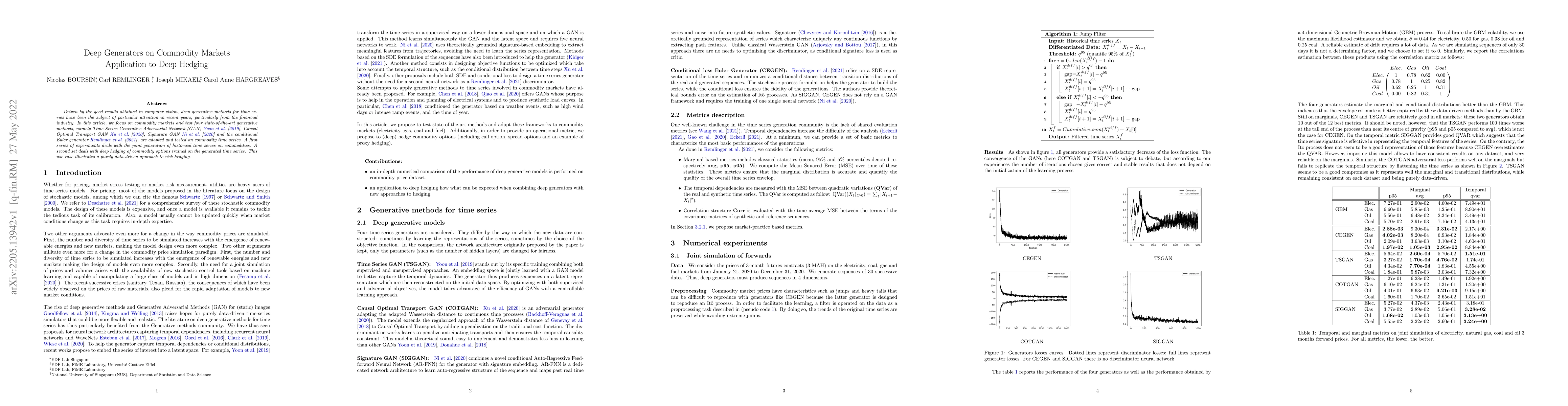

Driven by the good results obtained in computer vision, deep generative methods for time series have been the subject of particular attention in recent years, particularly from the financial industry. In this article, we focus on commodity markets and test four state-of-the-art generative methods, namely Time Series Generative Adversarial Network (GAN) Yoon et al. [2019], Causal Optimal Transport GAN Xu et al. [2020], Signature GAN Ni et al. [2020] and the conditional Euler generator Remlinger et al. [2021], are adapted and tested on commodity time series. A first series of experiments deals with the joint generation of historical time series on commodities. A second set deals with deep hedging of commodity options trained on he generated time series. This use case illustrates a purely data-driven approach to risk hedging.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Hedging of Green PPAs in Electricity Markets

Daniel Oeltz, Richard Biegler-König

A Topological Approach to Parameterizing Deep Hedging Networks

Kiseop Lee, Alok Das

| Title | Authors | Year | Actions |

|---|

Comments (0)