Summary

We present a machine learning approach for finding minimal equivalent martingale measures for markets simulators of tradable instruments, e.g. for a spot price and options written on the same underlying. We extend our results to markets with frictions, in which case we find "near-martingale measures" under which the prices of hedging instruments are martingales within their bid/ask spread. By removing the drift, we are then able to learn using Deep Hedging a "clean" hedge for an exotic payoff which is not polluted by the trading strategy trying to make money from statistical arbitrage opportunities. We correspondingly highlight the robustness of this hedge vs estimation error of the original market simulator. We discuss applications to two market simulators.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

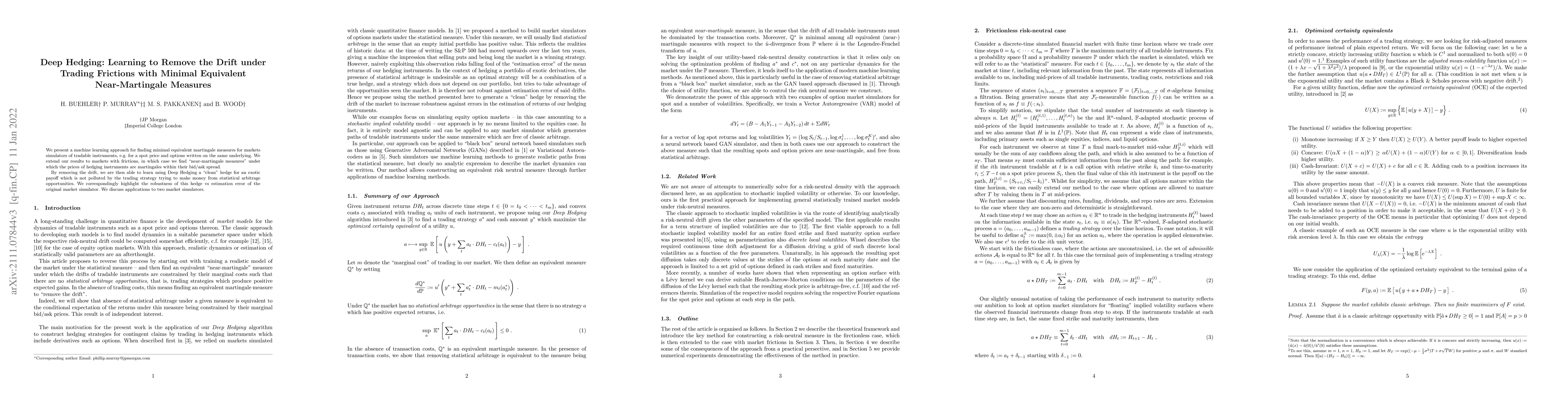

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning Algorithms for Hedging with Frictions

Xiaofei Shi, Zhanhao Zhang, Daran Xu

| Title | Authors | Year | Actions |

|---|

Comments (0)