Summary

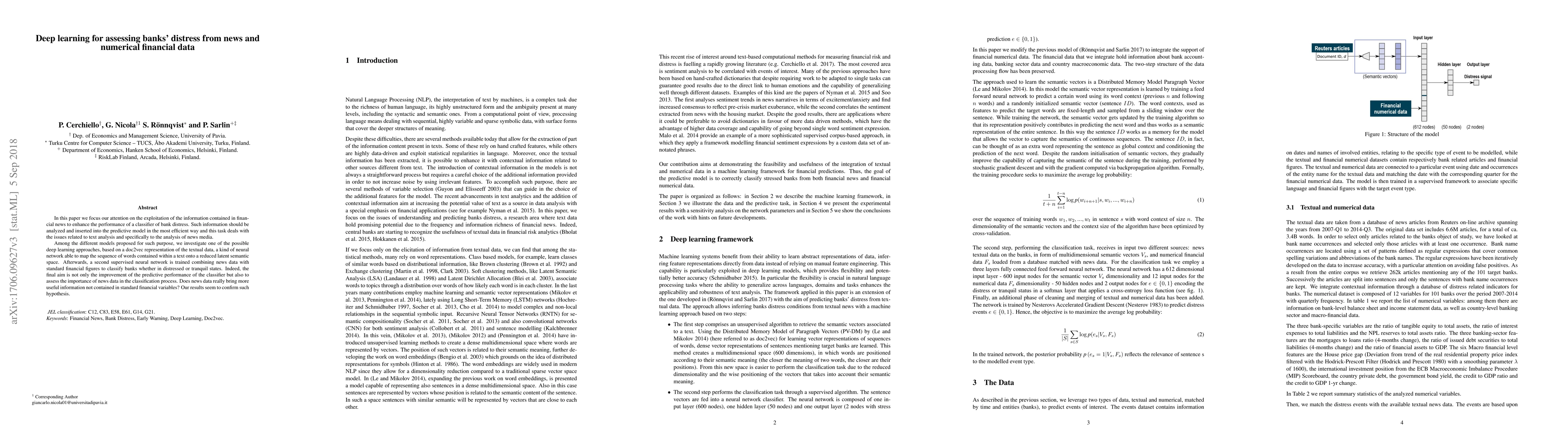

In this paper we focus our attention on the exploitation of the information contained in financial news to enhance the performance of a classifier of bank distress. Such information should be analyzed and inserted into the predictive model in the most efficient way and this task deals with all the issues related to text analysis and specifically analysis of news media. Among the different models proposed for such purpose, we investigate one of the possible deep learning approaches, based on a doc2vec representation of the textual data, a kind of neural network able to map the sequential and symbolic text input onto a reduced latent semantic space. Afterwards, a second supervised neural network is trained combining news data with standard financial figures to classify banks whether in distressed or tranquil states, based on a small set of known distress events. Then the final aim is not only the improvement of the predictive performance of the classifier but also to assess the importance of news data in the classification process. Does news data really bring more useful information not contained in standard financial variables? Our results seem to confirm such hypothesis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning Models Meet Financial Data Modalities

Mikhail Semenov, Kasymkhan Khubiev

Deep Multiple Instance Learning For Forecasting Stock Trends Using Financial News

Yiqi Deng, Siu Ming Yiu

| Title | Authors | Year | Actions |

|---|

Comments (0)