Authors

Summary

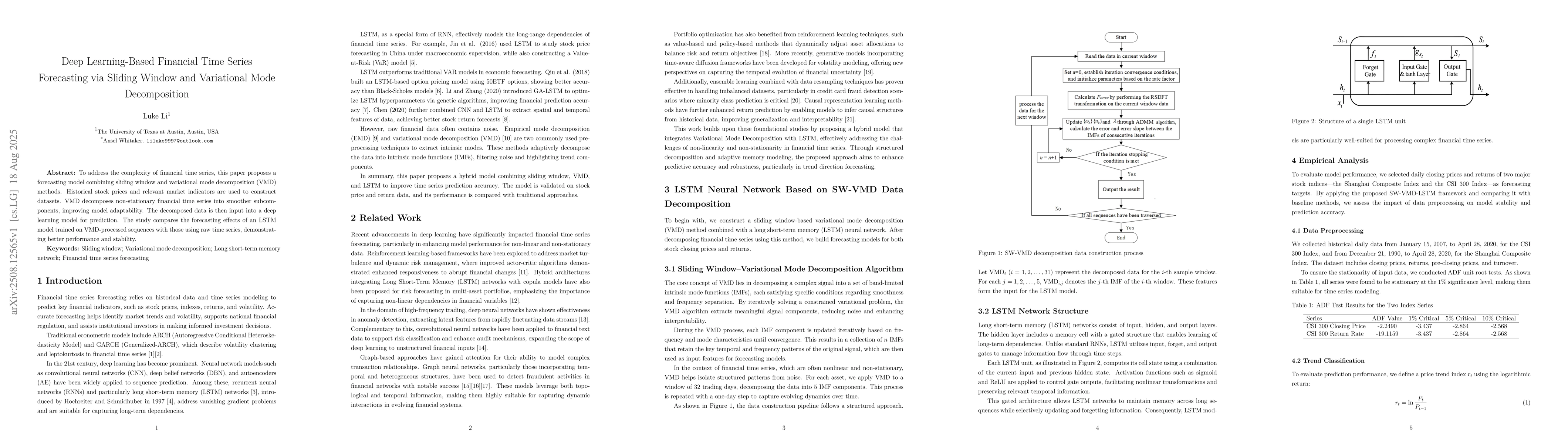

To address the complexity of financial time series, this paper proposes a forecasting model combining sliding window and variational mode decomposition (VMD) methods. Historical stock prices and relevant market indicators are used to construct datasets. VMD decomposes non-stationary financial time series into smoother subcomponents, improving model adaptability. The decomposed data is then input into a deep learning model for prediction. The study compares the forecasting effects of an LSTM model trained on VMD-processed sequences with those using raw time series, demonstrating better performance and stability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersActive Region-based Flare Forecasting with Sliding Window Multivariate Time Series Forest Classifiers

Berkay Aydin, Anli Ji

Data Scaling Effect of Deep Learning in Financial Time Series Forecasting

Chen Liu, Chao Wang, Richard Gerlach et al.

Variational Mode Decomposition and Linear Embeddings are What You Need For Time-Series Forecasting

Novanto Yudistira, Hafizh Raihan Kurnia Putra, Tirana Noor Fatyanosa

Comments (0)