Summary

In this paper, we propose a neural network-based method for CVA computations of a portfolio of derivatives. In particular, we focus on portfolios consisting of a combination of derivatives, with and without true optionality, \textit{e.g.,} a portfolio of a mix of European- and Bermudan-type derivatives. CVA is computed, with and without netting, for different levels of WWR and for different levels of credit quality of the counterparty. We show that the CVA is overestimated with up to 25\% by using the standard procedure of not adjusting the exercise strategy for the default-risk of the counterparty. For the Expected Shortfall of the CVA dynamics, the overestimation was found to be more than 100\% in some non-extreme cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

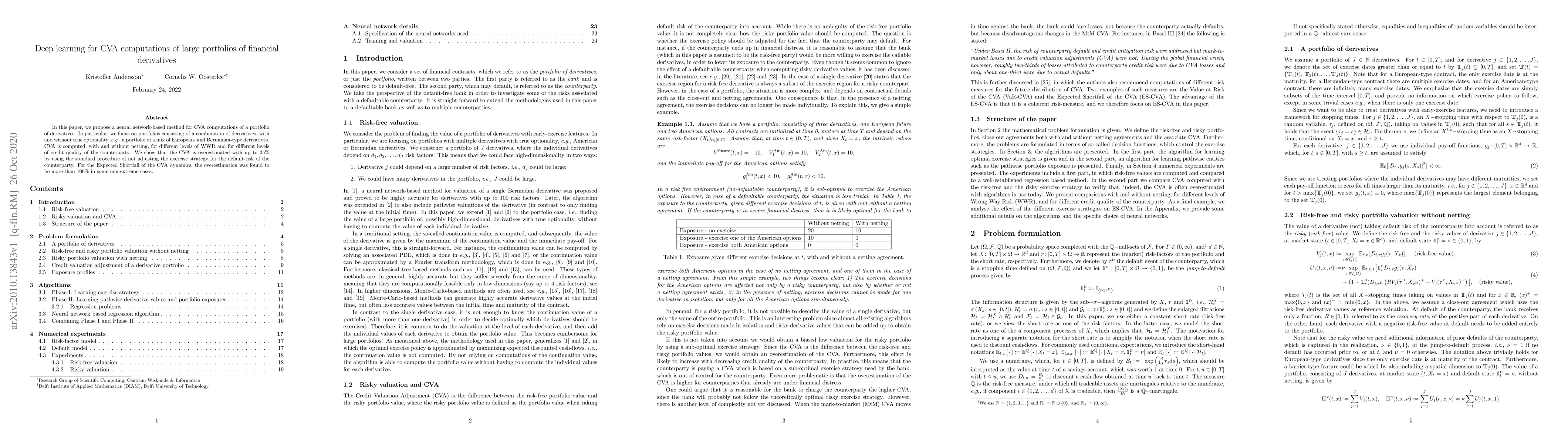

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)