Authors

Summary

This study proposes a behaviorally-informed multi-factor stock selection framework that integrates short-cycle technical alpha signals with deep learning. We design a dual-task multilayer perceptron (MLP) that jointly predicts five-day future returns and directional price movements, thereby capturing nonlinear market behaviors such as volume-price divergence, momentum-driven herding, and bottom reversals. The model is trained on 40 carefully constructed factors derived from price-volume patterns and behavioral finance insights. Empirical evaluation demonstrates that the dual-task MLP achieves superior and stable performance across both predictive accuracy and economic relevance, as measured by information coefficient (IC), information ratio (IR), and portfolio backtesting results. Comparative experiments further show that deep learning methods outperform linear baselines by effectively capturing structural interactions between factors. This work highlights the potential of structure-aware deep learning in enhancing multi-factor modeling and provides a practical framework for short-horizon quantitative investment strategies.

AI Key Findings

Generated Aug 21, 2025

Methodology

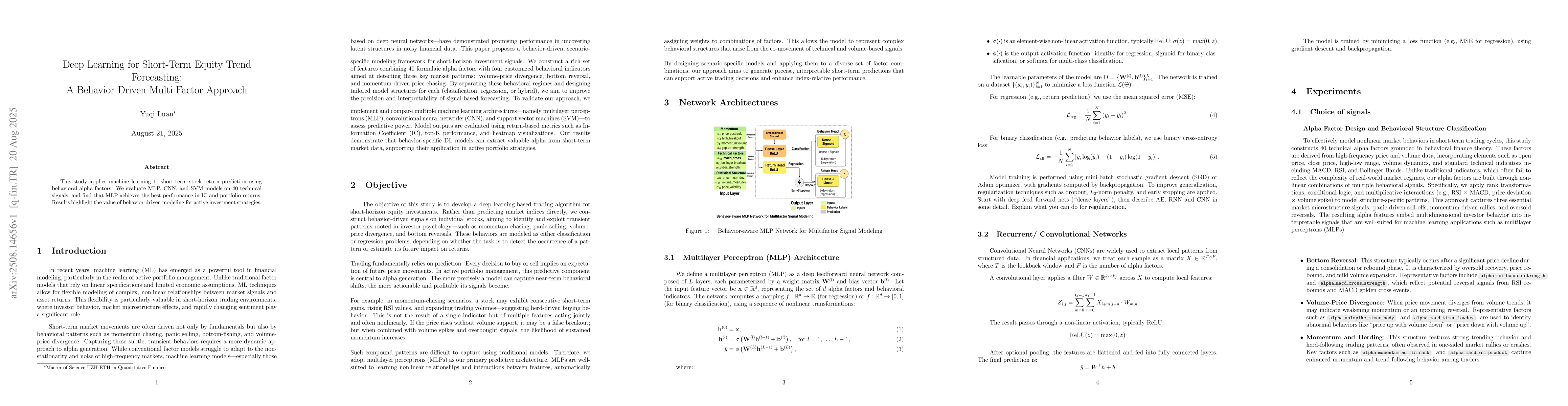

The study proposes a behaviorally-informed multi-factor stock selection framework integrating short-cycle technical alpha signals with deep learning using a dual-task multilayer perceptron (MLP) that predicts five-day future returns and directional price movements, capturing nonlinear market behaviors.

Key Results

- The dual-task MLP achieves superior and stable performance across predictive accuracy and economic relevance, as measured by information coefficient (IC), information ratio (IR), and portfolio backtesting results.

- Deep learning methods outperform linear baselines by effectively capturing structural interactions between factors.

- The MLP model significantly outperforms CNN and SVM models in terms of Information Coefficient (IC), Information Ratio (IR), and portfolio backtests, indicating higher predictive accuracy and robustness in alpha signal extraction.

Significance

This research highlights the potential of structure-aware deep learning in enhancing multi-factor modeling and provides a practical framework for short-horizon quantitative investment strategies.

Technical Contribution

The dual-task MLP architecture effectively combines regression and classification objectives, enhancing signal robustness and enabling the detection of behavioral market patterns such as bottom reversals, volume-price divergences, and momentum-driven herding.

Novelty

This work stands out by integrating behavioral finance insights with deep learning for short-term equity trend forecasting, outperforming traditional linear and shallow machine learning approaches in capturing nonlinear relationships and complex factor interactions.

Limitations

- Overfitting remains a concern, as performance heavily depends on data volume and regime stability.

- Interpretability is limited due to the black-box nature of neural networks, hindering intuitive understanding of factor contributions and investor behavior.

Future Work

- Explore structure-aware multi-task learning to incorporate behavioral event labels and jointly recognize structural signals and forecast returns.

- Develop regime-aware architectures leveraging gating or mixture-of-experts mechanisms informed by volatility, turnover, or breadth for enhanced adaptability under dynamic environments.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNonparametric Conditional Density Estimation In A Deep Learning Framework For Short-Term Forecasting

Short-Term Electricity-Load Forecasting by Deep Learning: A Comprehensive Survey

Jinyu Tian, Dave Towey, Ling Zhou et al.

Comments (0)