Authors

Summary

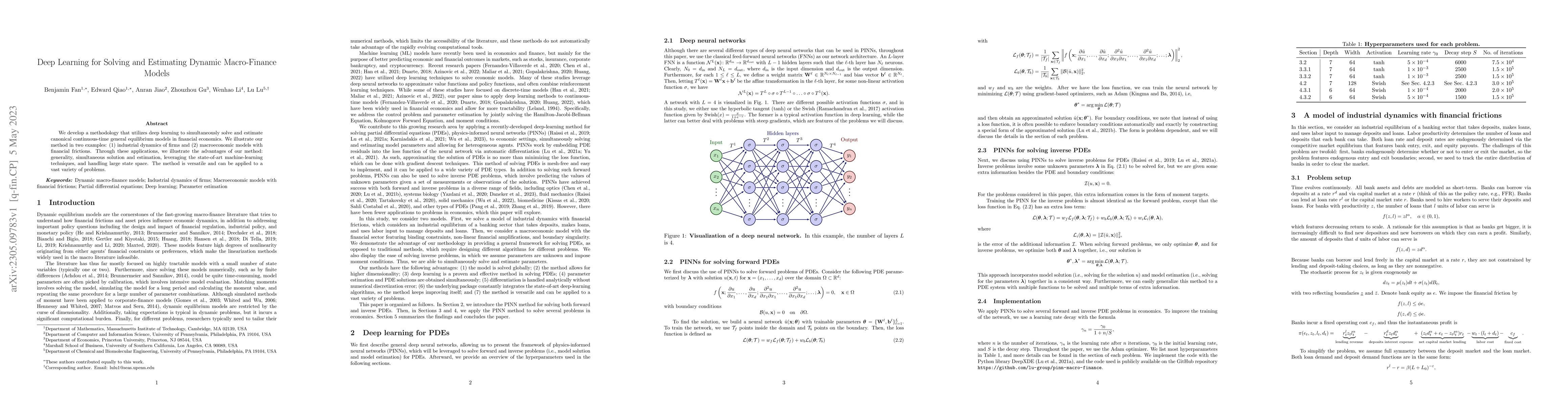

We develop a methodology that utilizes deep learning to simultaneously solve and estimate canonical continuous-time general equilibrium models in financial economics. We illustrate our method in two examples: (1) industrial dynamics of firms and (2) macroeconomic models with financial frictions. Through these applications, we illustrate the advantages of our method: generality, simultaneous solution and estimation, leveraging the state-of-art machine-learning techniques, and handling large state space. The method is versatile and can be applied to a vast variety of problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)