Summary

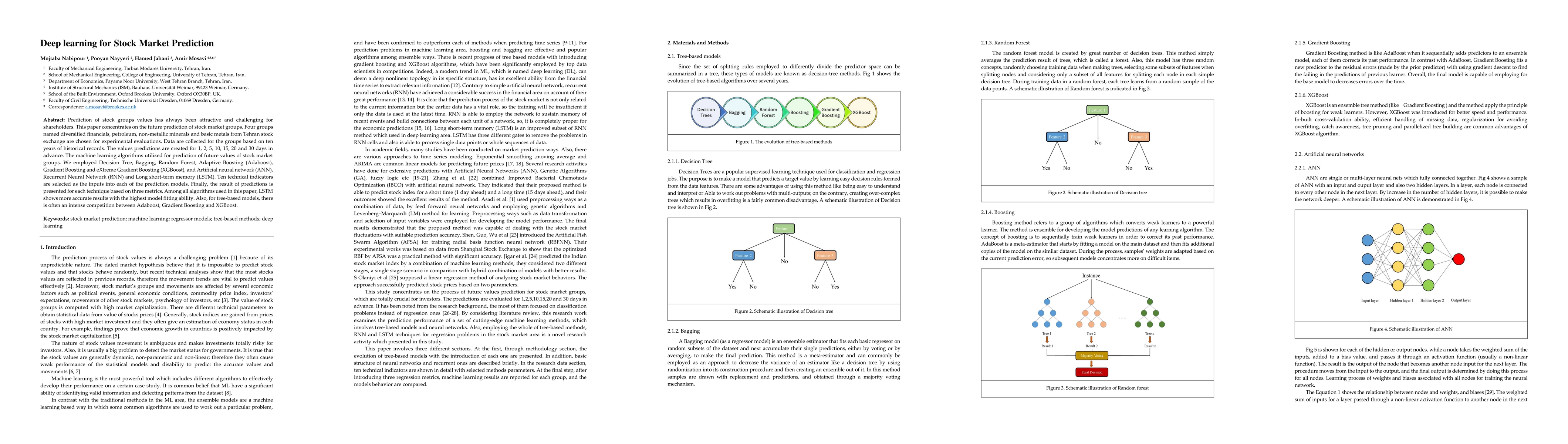

Prediction of stock groups' values has always been attractive and challenging for shareholders. This paper concentrates on the future prediction of stock market groups. Four groups named diversified financials, petroleum, non-metallic minerals and basic metals from Tehran stock exchange are chosen for experimental evaluations. Data are collected for the groups based on ten years of historical records. The values predictions are created for 1, 2, 5, 10, 15, 20 and 30 days in advance. The machine learning algorithms utilized for prediction of future values of stock market groups. We employed Decision Tree, Bagging, Random Forest, Adaptive Boosting (Adaboost), Gradient Boosting and eXtreme Gradient Boosting (XGBoost), and Artificial neural network (ANN), Recurrent Neural Network (RNN) and Long short-term memory (LSTM). Ten technical indicators are selected as the inputs into each of the prediction models. Finally, the result of predictions is presented for each technique based on three metrics. Among all the algorithms used in this paper, LSTM shows more accurate results with the highest model fitting ability. Also, for tree-based models, there is often an intense competition between Adaboost, Gradient Boosting, and XGBoost.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStock Market Prediction via Deep Learning Techniques: A Survey

Ehsan Abbasnejad, Lingqiao Liu, Javen Qinfeng Shi et al.

An Evaluation of Deep Learning Models for Stock Market Trend Prediction

Gonzalo Lopez Gil, Paul Duhamel-Sebline, Andrew McCarren

Transformer-Based Deep Learning Model for Stock Price Prediction: A Case Study on Bangladesh Stock Market

Mohammad Shafiul Alam, Muhammad Ibrahim, Tashreef Muhammad et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)