Summary

In this paper, we present a probabilistic numerical method for a class of forward utilities in a stochastic factor model. For this purpose, we use the representation of dynamic consistent utilities with mean of ergodic Backward Stochastic Differential Equations (eBSDEs) introduced by Liang and Zariphopoulou in [27]. We establish a connection between the solution of the ergodic BSDE and the solution of an associated BSDE with random terminal time $\tau$ , defined as the hitting time of the positive recurrent stochastic factor V . The viewpoint based on BSDEs with random horizon yields a new characterization of the ergodic cost $\lambda$ which is a part of the solution of the eBSDEs. In particular, for a certain class of eBSDEs with quadratic generator, the Cole-Hopf transform leads to a semi-explicit representation of the solution as well as a new expression of the ergodic cost $\lambda$. The latter can be estimated with Monte Carlo methods. We also propose two new deep learning numerical schemes for eBSDEs, where the ergodic cost $\lambda$ is optimized according to a loss function at the random horizon $\tau$ or taking into account the whole trajectory. Finally, we present numerical results for different examples of eBSDEs and forward utilities along with the associated investment strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

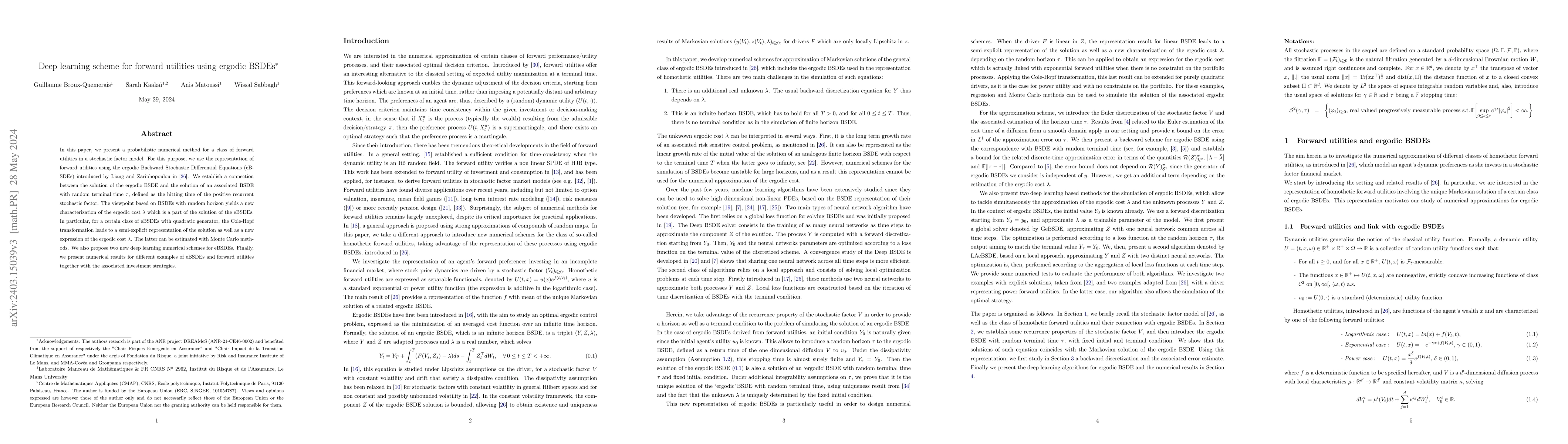

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA new monotonicity condition for ergodic BSDEs and ergodic control with super-quadratic Hamiltonians

Gechun Liang, Joe Jackson

| Title | Authors | Year | Actions |

|---|

Comments (0)