Authors

Summary

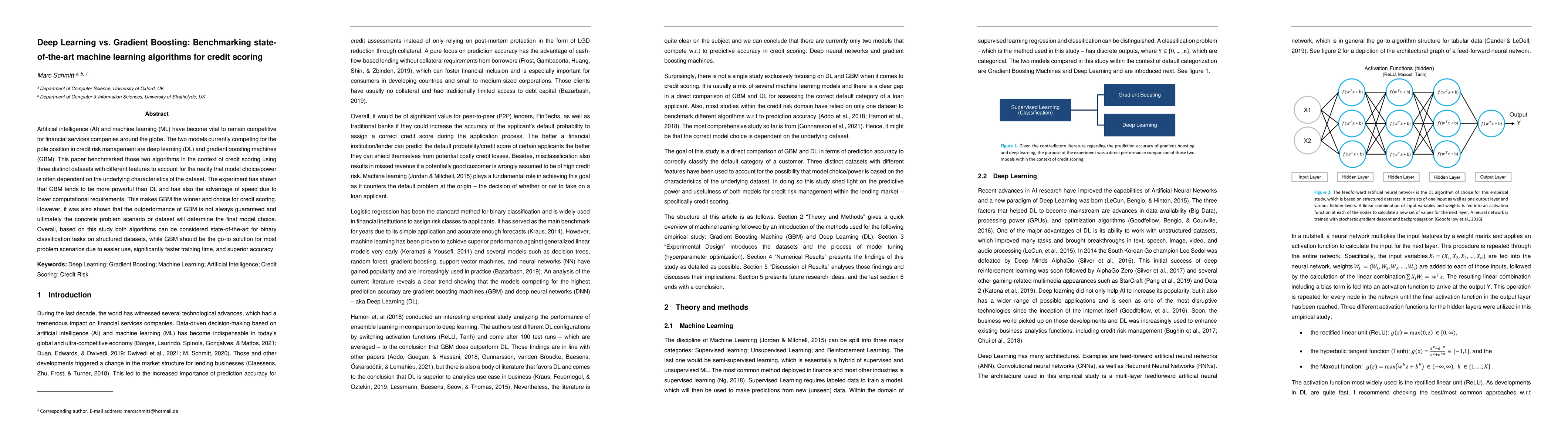

Artificial intelligence (AI) and machine learning (ML) have become vital to remain competitive for financial services companies around the globe. The two models currently competing for the pole position in credit risk management are deep learning (DL) and gradient boosting machines (GBM). This paper benchmarked those two algorithms in the context of credit scoring using three distinct datasets with different features to account for the reality that model choice/power is often dependent on the underlying characteristics of the dataset. The experiment has shown that GBM tends to be more powerful than DL and has also the advantage of speed due to lower computational requirements. This makes GBM the winner and choice for credit scoring. However, it was also shown that the outperformance of GBM is not always guaranteed and ultimately the concrete problem scenario or dataset will determine the final model choice. Overall, based on this study both algorithms can be considered state-of-the-art for binary classification tasks on structured datasets, while GBM should be the go-to solution for most problem scenarios due to easier use, significantly faster training time, and superior accuracy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBenchmarking state-of-the-art gradient boosting algorithms for classification

Adam Zagdański, Piotr Florek

| Title | Authors | Year | Actions |

|---|

Comments (0)