Summary

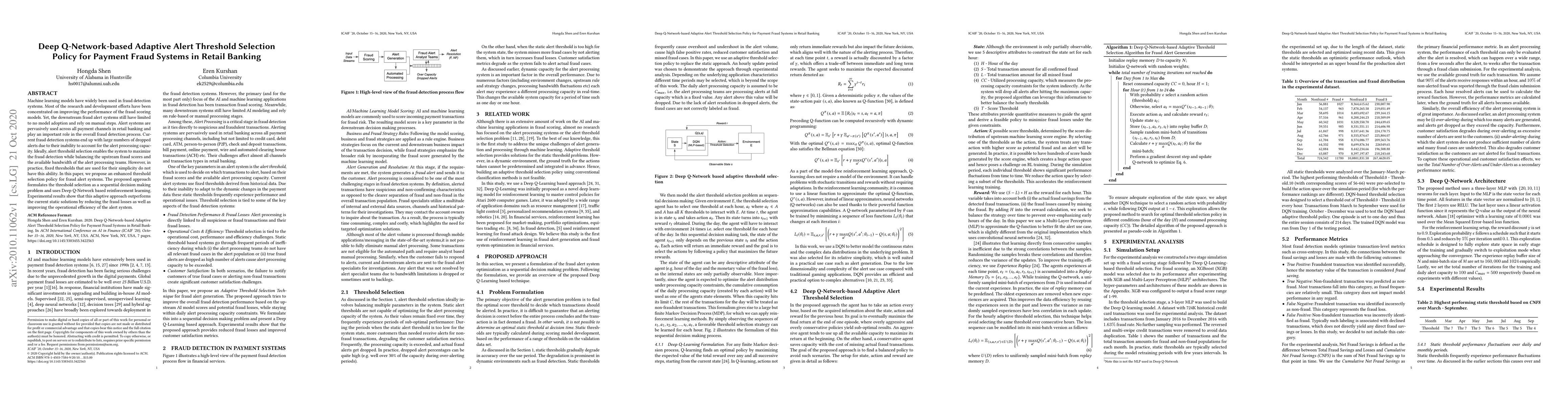

Machine learning models have widely been used in fraud detection systems. Most of the research and development efforts have been concentrated on improving the performance of the fraud scoring models. Yet, the downstream fraud alert systems still have limited to no model adoption and rely on manual steps. Alert systems are pervasively used across all payment channels in retail banking and play an important role in the overall fraud detection process. Current fraud detection systems end up with large numbers of dropped alerts due to their inability to account for the alert processing capacity. Ideally, alert threshold selection enables the system to maximize the fraud detection while balancing the upstream fraud scores and the available bandwidth of the alert processing teams. However, in practice, fixed thresholds that are used for their simplicity do not have this ability. In this paper, we propose an enhanced threshold selection policy for fraud alert systems. The proposed approach formulates the threshold selection as a sequential decision making problem and uses Deep Q-Network based reinforcement learning. Experimental results show that this adaptive approach outperforms the current static solutions by reducing the fraud losses as well as improving the operational efficiency of the alert system.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)