Summary

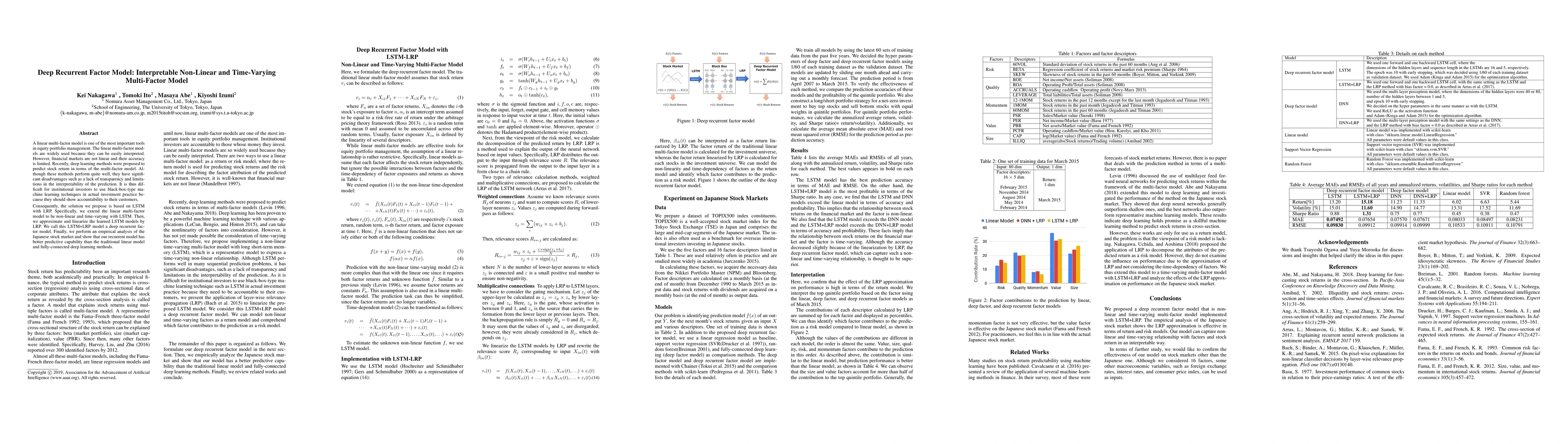

A linear multi-factor model is one of the most important tools in equity portfolio management. The linear multi-factor models are widely used because they can be easily interpreted. However, financial markets are not linear and their accuracy is limited. Recently, deep learning methods were proposed to predict stock return in terms of the multi-factor model. Although these methods perform quite well, they have significant disadvantages such as a lack of transparency and limitations in the interpretability of the prediction. It is thus difficult for institutional investors to use black-box-type machine learning techniques in actual investment practice because they should show accountability to their customers. Consequently, the solution we propose is based on LSTM with LRP. Specifically, we extend the linear multi-factor model to be non-linear and time-varying with LSTM. Then, we approximate and linearize the learned LSTM models by LRP. We call this LSTM+LRP model a deep recurrent factor model. Finally, we perform an empirical analysis of the Japanese stock market and show that our recurrent model has better predictive capability than the traditional linear model and fully-connected deep learning methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)