Summary

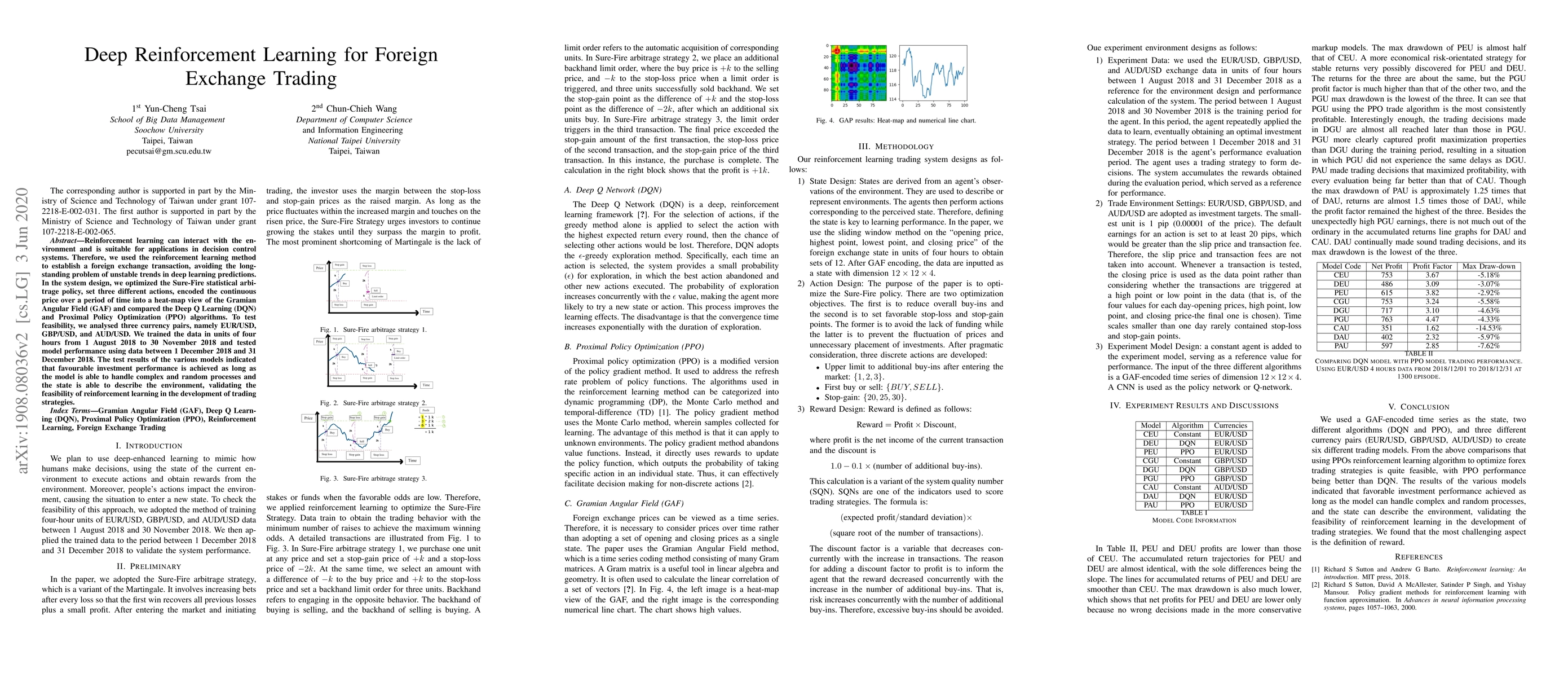

Reinforcement learning can interact with the environment and is suitable for applications in decision control systems. Therefore, we used the reinforcement learning method to establish a foreign exchange transaction, avoiding the long-standing problem of unstable trends in deep learning predictions. In the system design, we optimized the Sure-Fire statistical arbitrage policy, set three different actions, encoded the continuous price over a period of time into a heat-map view of the Gramian Angular Field (GAF) and compared the Deep Q Learning (DQN) and Proximal Policy Optimization (PPO) algorithms. To test feasibility, we analyzed three currency pairs, namely EUR/USD, GBP/USD, and AUD/USD. We trained the data in units of four hours from 1 August 2018 to 30 November 2018 and tested model performance using data between 1 December 2018 and 31 December 2018. The test results of the various models indicated that favorable investment performance was achieved as long as the model was able to handle complex and random processes and the state was able to describe the environment, validating the feasibility of reinforcement learning in the development of trading strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep reinforcement learning with positional context for intraday trading

Sven Goluža, Tomislav Kovačević, Tessa Bauman et al.

Deep Reinforcement Learning for Quantitative Trading

Jiawei Du, Zheng Tao, Zixun Lan et al.

Combining Deep Learning on Order Books with Reinforcement Learning for Profitable Trading

Koti S. Jaddu, Paul A. Bilokon

| Title | Authors | Year | Actions |

|---|

Comments (0)