Summary

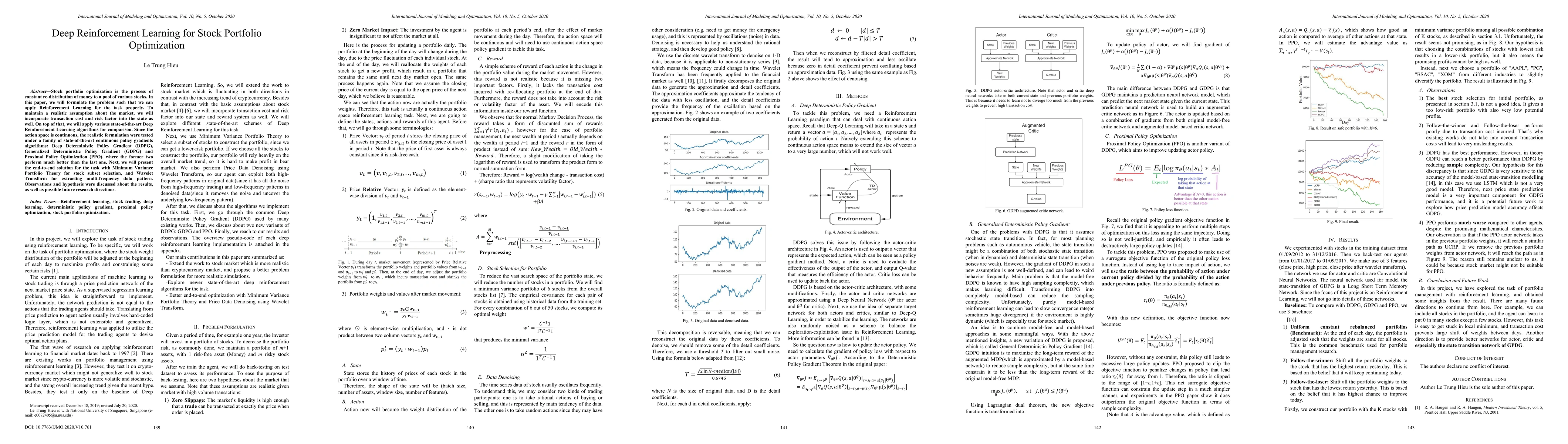

Stock portfolio optimization is the process of constant re-distribution of money to a pool of various stocks. In this paper, we will formulate the problem such that we can apply Reinforcement Learning for the task properly. To maintain a realistic assumption about the market, we will incorporate transaction cost and risk factor into the state as well. On top of that, we will apply various state-of-the-art Deep Reinforcement Learning algorithms for comparison. Since the action space is continuous, the realistic formulation were tested under a family of state-of-the-art continuous policy gradients algorithms: Deep Deterministic Policy Gradient (DDPG), Generalized Deterministic Policy Gradient (GDPG) and Proximal Policy Optimization (PPO), where the former two perform much better than the last one. Next, we will present the end-to-end solution for the task with Minimum Variance Portfolio Theory for stock subset selection, and Wavelet Transform for extracting multi-frequency data pattern. Observations and hypothesis were discussed about the results, as well as possible future research directions.1

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultimodal Deep Reinforcement Learning for Portfolio Optimization

James Zhang, Sumit Nawathe, Ravi Panguluri et al.

Deep Reinforcement Learning and Mean-Variance Strategies for Responsible Portfolio Optimization

Manuela Veloso, Fernando Acero, Parisa Zehtabi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)