Summary

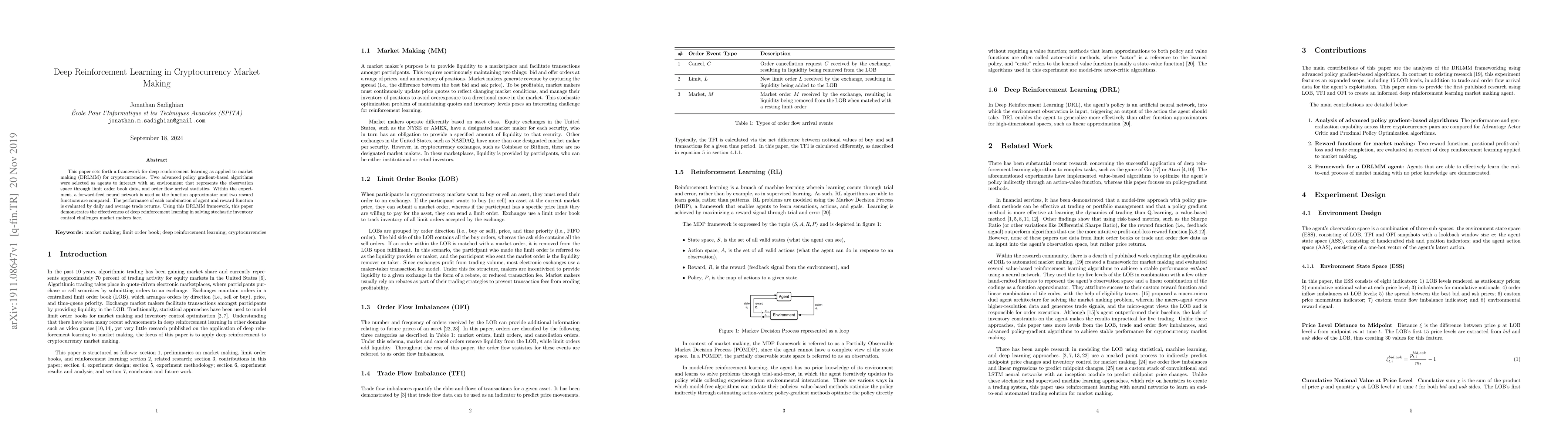

This paper sets forth a framework for deep reinforcement learning as applied to market making (DRLMM) for cryptocurrencies. Two advanced policy gradient-based algorithms were selected as agents to interact with an environment that represents the observation space through limit order book data, and order flow arrival statistics. Within the experiment, a forward-feed neural network is used as the function approximator and two reward functions are compared. The performance of each combination of agent and reward function is evaluated by daily and average trade returns. Using this DRLMM framework, this paper demonstrates the effectiveness of deep reinforcement learning in solving stochastic inventory control challenges market makers face.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket Making via Reinforcement Learning in China Commodity Market

Junshu Jiang, Thomas Dierckx, Wim Schoutens et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)