Authors

Summary

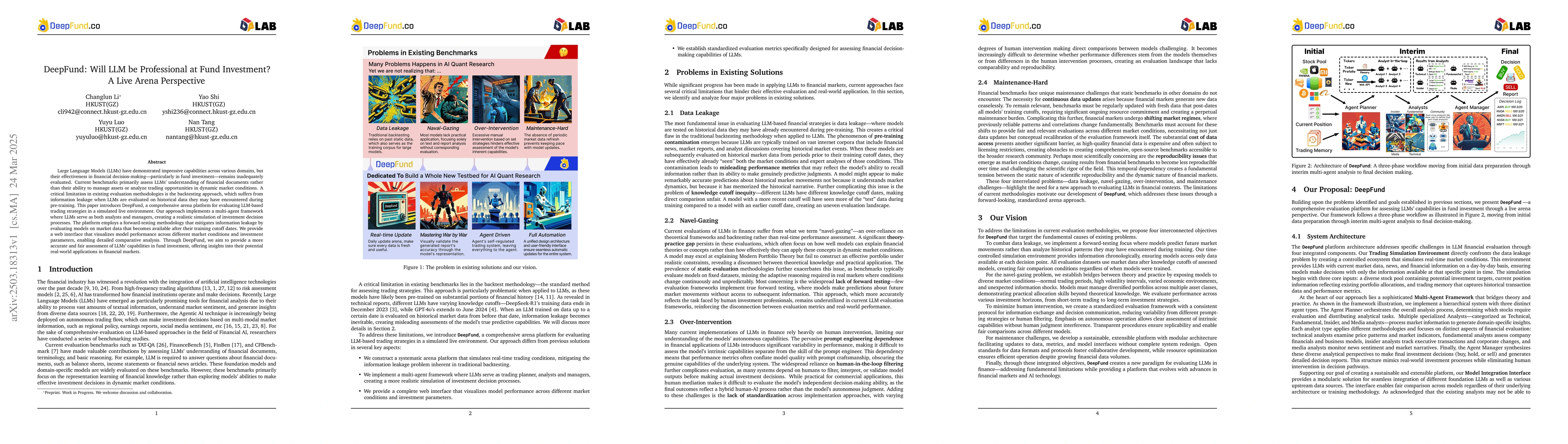

Large Language Models (LLMs) have demonstrated impressive capabilities across various domains, but their effectiveness in financial decision making, particularly in fund investment, remains inadequately evaluated. Current benchmarks primarily assess LLMs understanding of financial documents rather than their ability to manage assets or analyze trading opportunities in dynamic market conditions. A critical limitation in existing evaluation methodologies is the backtesting approach, which suffers from information leakage when LLMs are evaluated on historical data they may have encountered during pretraining. This paper introduces DeepFund, a comprehensive platform for evaluating LLM based trading strategies in a simulated live environment. Our approach implements a multi agent framework where LLMs serve as both analysts and managers, creating a realistic simulation of investment decision making. The platform employs a forward testing methodology that mitigates information leakage by evaluating models on market data released after their training cutoff dates. We provide a web interface that visualizes model performance across different market conditions and investment parameters, enabling detailed comparative analysis. Through DeepFund, we aim to provide a more accurate and fair assessment of LLMs capabilities in fund investment, offering insights into their potential real world applications in financial markets.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research introduces DeepFund, a comprehensive platform for evaluating LLM-based trading strategies in a simulated live environment. It implements a multi-agent framework where LLMs act as analysts and managers, simulating realistic investment decision-making. The platform uses forward testing to mitigate information leakage by evaluating models on market data released after their training cutoff dates.

Key Results

- DeepFund addresses critical limitations in existing evaluation methodologies for LLMs in financial decision-making.

- The platform implements standardized evaluation metrics specifically designed for assessing LLMs' financial decision-making capabilities.

Significance

DeepFund aims to provide a more accurate and fair assessment of LLMs' capabilities in fund investment, offering insights into their potential real-world applications in financial markets.

Technical Contribution

DeepFund's technical contribution lies in its forward testing methodology and multi-agent framework, which mitigate information leakage and bridge the gap between theoretical knowledge and practical application in financial decision-making.

Novelty

DeepFund's novelty stems from its comprehensive approach to evaluating LLMs in fund investment, addressing critical limitations in existing benchmarks through a forward-looking, standardized arena approach.

Limitations

- The paper does not discuss potential limitations or challenges in implementing the DeepFund platform in real-world scenarios.

- No information is provided on the scalability of the proposed methodology with increasing complexity of financial markets.

Future Work

- Further research could focus on integrating DeepFund with actual financial market data for real-world testing and validation.

- Investigating the adaptability of LLMs to rapidly changing market conditions and regime shifts could be an area for future exploration.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTime Travel is Cheating: Going Live with DeepFund for Real-Time Fund Investment Benchmarking

Chen Wang, Nan Tang, Yuyu Luo et al.

Music Arena: Live Evaluation for Text-to-Music

Shinji Watanabe, Yuki Mitsufuji, Koichi Saito et al.

Which Matters Most in Making Fund Investment Decisions? A Multi-granularity Graph Disentangled Learning Framework

Zhiqiang Zhang, Binbin Hu, Jun Zhou et al.

No citations found for this paper.

Comments (0)