Authors

Summary

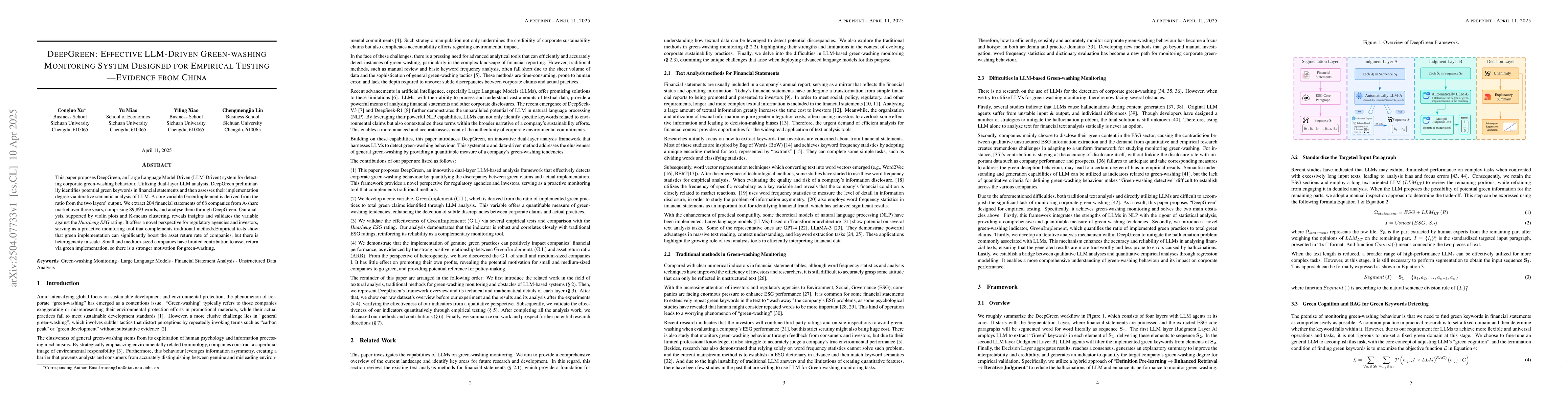

This paper proposes DeepGreen, an Large Language Model Driven (LLM-Driven) system for detecting corporate green-washing behaviour. Utilizing dual-layer LLM analysis, DeepGreen preliminarily identifies potential green keywords in financial statements and then assesses their implementation degree via iterative semantic analysis of LLM. A core variable GreenImplement is derived from the ratio from the two layers' output. We extract 204 financial statements of 68 companies from A-share market over three years, comprising 89,893 words, and analyse them through DeepGreen. Our analysis, supported by violin plots and K-means clustering, reveals insights and validates the variable against the Huazheng ESG rating. It offers a novel perspective for regulatory agencies and investors, serving as a proactive monitoring tool that complements traditional methods.Empirical tests show that green implementation can significantly boost the asset return rate of companies, but there is heterogeneity in scale. Small and medium-sized companies have limited contribution to asset return via green implementation, so there is a stronger motivation for green-washing.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research proposes DeepGreen, an LLM-Driven system using dual-layer analysis to detect green-washing in financial statements. It utilizes a low-cost, open-source LLM, DeepSeek-V3, for text analysis, ensuring large-scale analysis feasibility while allowing enterprises to train their own low-cost financial models.

Key Results

- DeepGreen's GreenImplement variable shows a significant positive relationship with asset return rate (ARR), indicating genuine green practices lead to superior financial performance.

- Empirical tests reveal heterogeneity in the impact of green implementation on ARR, with small and medium-sized companies showing limited contribution, thus having a stronger motivation for green-washing.

- The system's output correlates closely with traditional Huazheng ESG scores, reinforcing its reliability as a complementary monitoring tool.

- K-means clustering analysis supports the findings, revealing inconsistencies between green implementation and ESG scores, especially for small and medium-sized companies.

- DeepGreen identifies potential motivations for small and medium-sized companies to engage in greenwashing, as high green implementation does not significantly increase their growth.

Significance

This research introduces DeepGreen, an innovative system that leverages LLMs for monitoring green-washing behavior in A-share companies, enhancing detection and providing detailed, interpretable reports for improved transparency and credibility.

Technical Contribution

DeepGreen employs a dual-layer LLM analysis for extracting potential green keywords from financial statements and evaluating their implementation degree, generating a novel GreenImplement indicator for green-washing monitoring.

Novelty

DeepGreen distinguishes itself by using a low-cost, open-source LLM for large-scale analysis, allowing enterprises to train their own financial models. It also offers detailed, interpretable reports and correlates well with traditional ESG scores, providing a valuable complementary monitoring tool.

Limitations

- The study relies on non-financial fine-tuned LLMs, which, despite their efficiency, may still encounter hallucinations impacting output accuracy.

- DeepGreen is not a replacement for existing monitoring and rating methods but serves as a supplement, improving financial statement analysis efficiency.

- The research focuses on A-share companies in China, limiting the generalizability of findings to other markets or industries.

Future Work

- Develop more robust techniques to address LLM hallucinations and improve output accuracy.

- Conduct comparative analyses of global rating systems and explore the universality of DeepGreen under diverse rating systems.

- Investigate the potential of hybrid models integrating LLMs with traditional analytical tools for enhanced performance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCarbon co-benefits of digital economy and green finance: empirical evidence from China.

Zhang, Zhenhua, Ren, Yayun, Xu, Xiaohang et al.

Quality Assurance for LLM-RAG Systems: Empirical Insights from Tourism Application Testing

Firas Bayram, Bestoun S. Ahmed, Ludwig Otto Baader et al.

The Green Premium Puzzle: Empirical Evidence from Climate-Friendly Food Products

Voraprapa Nakavachara, Chanon Thongtai, Thanarat Chalidabhongse et al.

No citations found for this paper.

Comments (0)