Authors

Summary

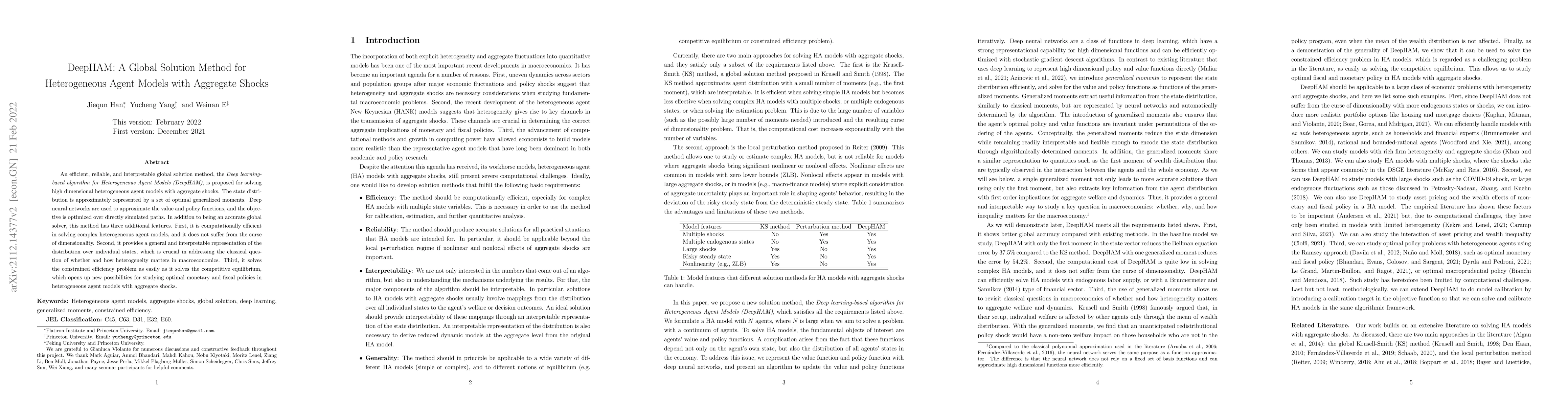

An efficient, reliable, and interpretable global solution method, the Deep learning-based algorithm for Heterogeneous Agent Models (DeepHAM), is proposed for solving high dimensional heterogeneous agent models with aggregate shocks. The state distribution is approximately represented by a set of optimal generalized moments. Deep neural networks are used to approximate the value and policy functions, and the objective is optimized over directly simulated paths. In addition to being an accurate global solver, this method has three additional features. First, it is computationally efficient in solving complex heterogeneous agent models, and it does not suffer from the curse of dimensionality. Second, it provides a general and interpretable representation of the distribution over individual states, which is crucial in addressing the classical question of whether and how heterogeneity matters in macroeconomics. Third, it solves the constrained efficiency problem as easily as it solves the competitive equilibrium, which opens up new possibilities for studying optimal monetary and fiscal policies in heterogeneous agent models with aggregate shocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGlobal Solutions to Master Equations for Continuous Time Heterogeneous Agent Macroeconomic Models

Mathieu Laurière, Zhouzhou Gu, Sebastian Merkel et al.

Estimation with Aggregate Shocks

Guido Kuersteiner, Jinyong Hahn, Maurizio Mazzocco

| Title | Authors | Year | Actions |

|---|

Comments (0)