Summary

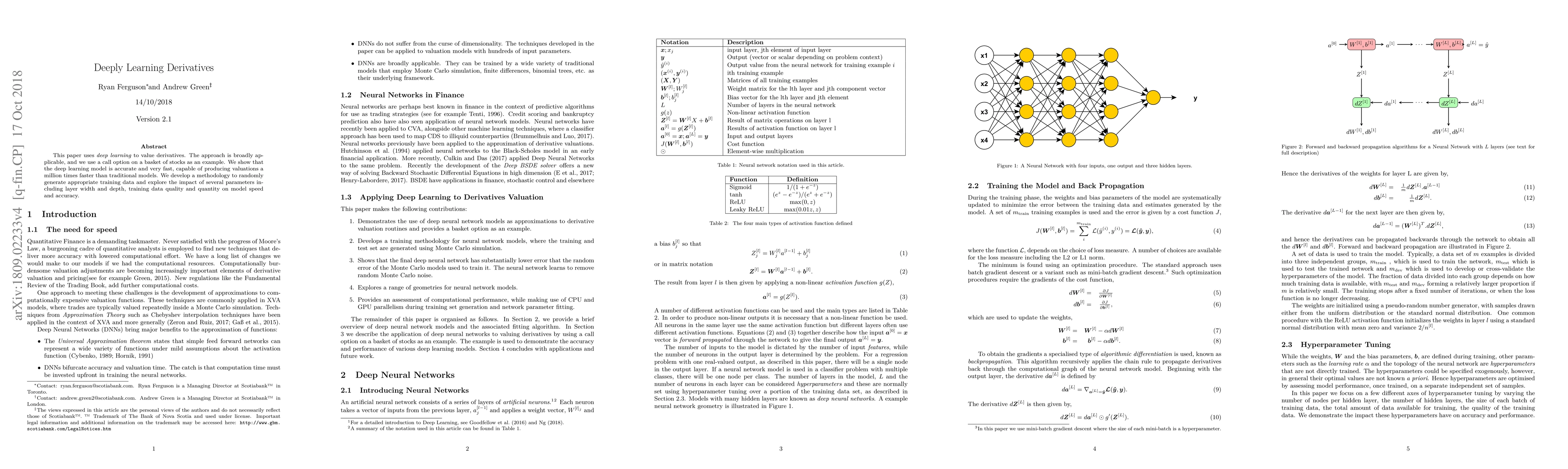

This paper uses deep learning to value derivatives. The approach is broadly applicable, and we use a call option on a basket of stocks as an example. We show that the deep learning model is accurate and very fast, capable of producing valuations a million times faster than traditional models. We develop a methodology to randomly generate appropriate training data and explore the impact of several parameters including layer width and depth, training data quality and quantity on model speed and accuracy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeeply Coupled Cross-Modal Prompt Learning

Rui Zhao, Fei Tan, Jinghui Lu et al.

Deeply Supervised Active Learning for Finger Bones Segmentation

Xiaoyan Yang, Bharadwaj Veeravalli, Ziyuan Zhao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)