Authors

Summary

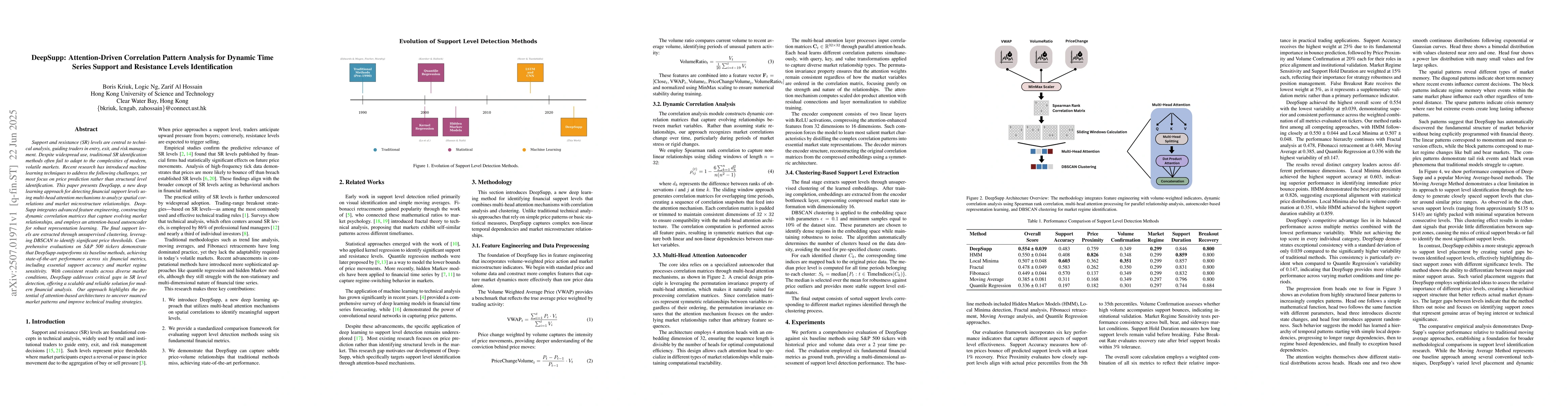

Support and resistance (SR) levels are central to technical analysis, guiding traders in entry, exit, and risk management. Despite widespread use, traditional SR identification methods often fail to adapt to the complexities of modern, volatile markets. Recent research has introduced machine learning techniques to address the following challenges, yet most focus on price prediction rather than structural level identification. This paper presents DeepSupp, a new deep learning approach for detecting financial support levels using multi-head attention mechanisms to analyze spatial correlations and market microstructure relationships. DeepSupp integrates advanced feature engineering, constructing dynamic correlation matrices that capture evolving market relationships, and employs an attention-based autoencoder for robust representation learning. The final support levels are extracted through unsupervised clustering, leveraging DBSCAN to identify significant price thresholds. Comprehensive evaluations on S&P 500 tickers demonstrate that DeepSupp outperforms six baseline methods, achieving state-of-the-art performance across six financial metrics, including essential support accuracy and market regime sensitivity. With consistent results across diverse market conditions, DeepSupp addresses critical gaps in SR level detection, offering a scalable and reliable solution for modern financial analysis. Our approach highlights the potential of attention-based architectures to uncover nuanced market patterns and improve technical trading strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersXicorAttention: Time Series Transformer Using Attention with Nonlinear Correlation

Hisashi Kashima, Daichi Kimura, Tomonori Izumitani

No citations found for this paper.

Comments (0)