Summary

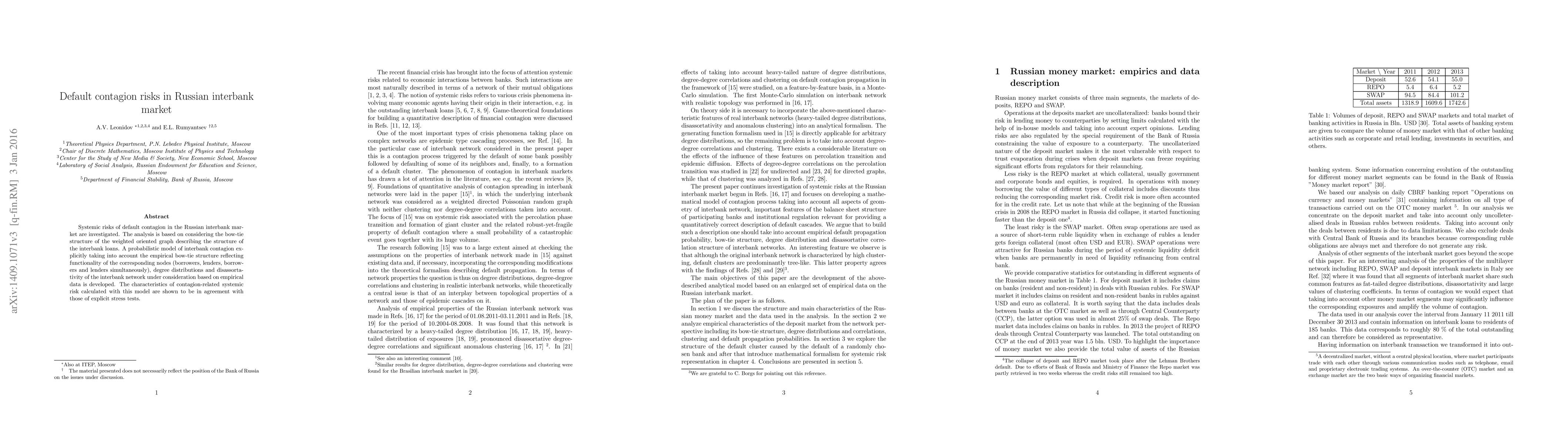

Systemic risks of default contagion in the Russian interbank market are investigated. The analysis is based on considering the bow-tie structure of the weighted oriented graph describing the structure of the interbank loans. A probabilistic model of interbank contagion explicitly taking into account the empirical bow-tie structure reflecting functionality of the corresponding nodes (borrowers, lenders, borrowers and lenders simultaneously), degree distributions and disassortativity of the interbank network under consideration based on empirical data is developed. The characteristics of contagion-related systemic risk calculated with this model are shown to be in agreement with those of explicit stress tests.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)