Summary

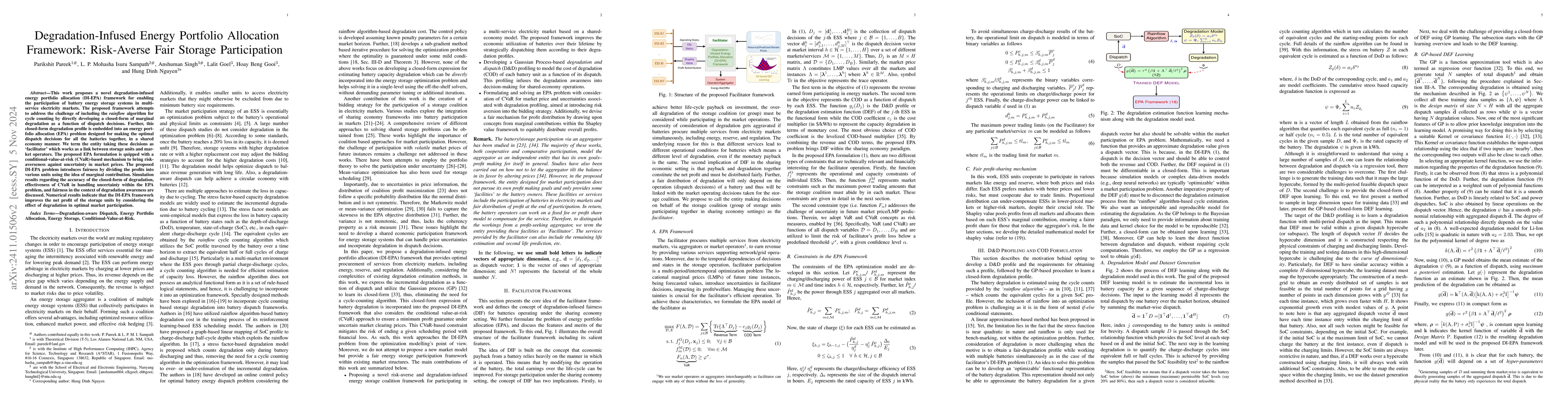

This work proposes a novel degradation-infused energy portfolio allocation (DI-EPA) framework for enabling the participation of battery energy storage systems in multi-service electricity markets. The proposed framework attempts to address the challenge of including the rainflow algorithm for cycle counting by directly developing a closed-form of marginal degradation as a function of dispatch decisions. Further, this closed-form degradation profile is embedded into an energy portfolio allocation (EPA) problem designed for making the optimal dispatch decisions for all the batteries together, in a shared economy manner. We term the entity taking these decisions as `facilitator' which works as a link between storage units and market operators. The proposed EPA formulation is quipped with a conditional-value-at-risk (CVaR)-based mechanism to bring risk-averseness against uncertainty in market prices. The proposed DI-EPA problem introduces fairness by dividing the profits into various units using the idea of marginal contribution. Simulation results regarding the accuracy of the closed-form of degradation, effectiveness of CVaR in handling uncertainty within the EPA problem, and fairness in the context of degradation awareness are discussed. Numerical results indicate that the DI-EPA framework improves the net profit of the storage units by considering the effect of degradation in optimal market participation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConformal Uncertainty Quantification of Electricity Price Predictions for Risk-Averse Storage Arbitrage

Ming Yi, Bolun Xu, Saud Alghumayjan

Risk-Averse Self-Scheduling of Storage in Decentralized Markets

Ogun Yurdakul, Farhad Billimoria

Fair Energy Allocation in Risk-aware Energy Communities

Gabriela Hug, Lesia Mitridati, Ioannis Stavrakakis et al.

No citations found for this paper.

Comments (0)