Summary

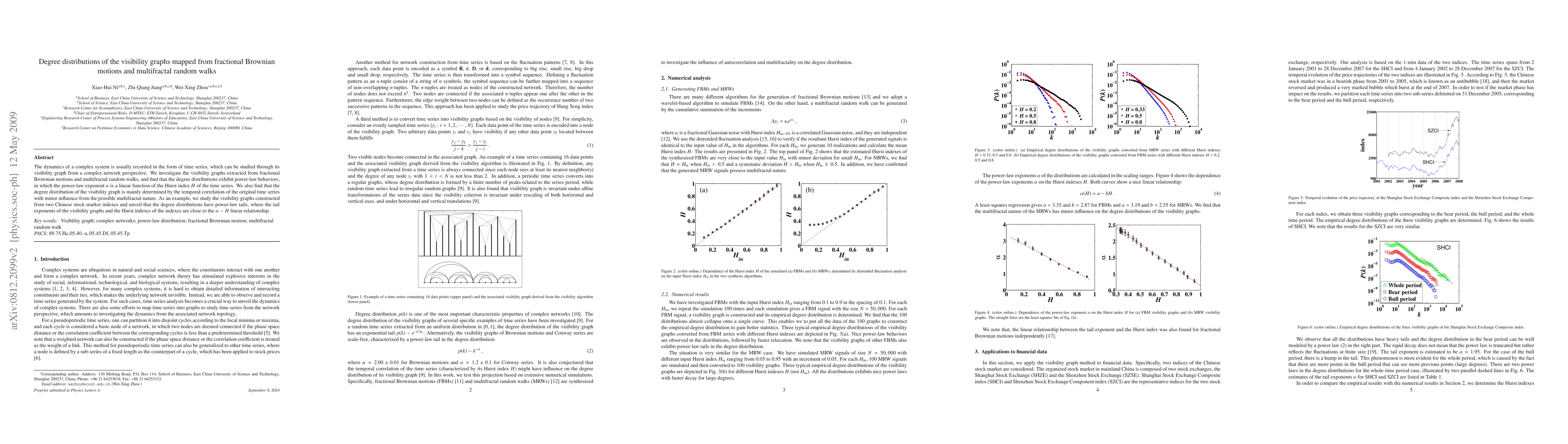

The dynamics of a complex system is usually recorded in the form of time series, which can be studied through its visibility graph from a complex network perspective. We investigate the visibility graphs extracted from fractional Brownian motions and multifractal random walks, and find that the degree distributions exhibit power-law behaviors, in which the power-law exponent $\alpha$ is a linear function of the Hurst index $H$ of the time series. We also find that the degree distribution of the visibility graph is mainly determined by the temporal correlation of the original time series with minor influence from the possible multifractal nature. As an example, we study the visibility graphs constructed from two Chinese stock market indexes and unveil that the degree distributions have power-law tails, where the tail exponents of the visibility graphs and the Hurst indexes of the indexes are close to the $\alpha\sim H$ linear relationship.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)