Summary

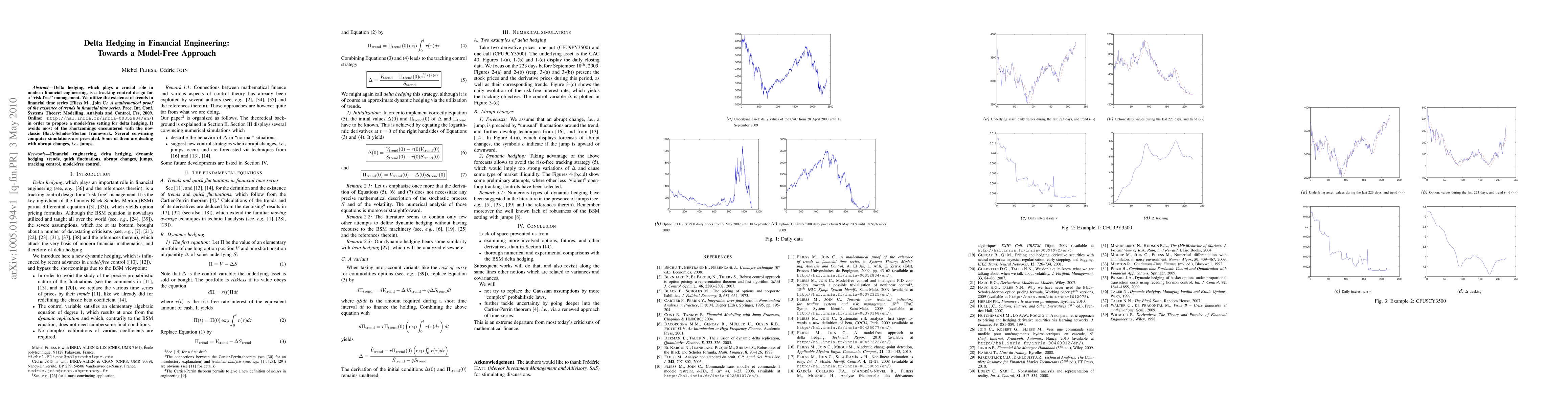

Delta hedging, which plays a crucial r\^ole in modern financial engineering, is a tracking control design for a "risk-free" management. We utilize the existence of trends in financial time series (Fliess M., Join C.: A mathematical proof of the existence of trends in financial time series, Proc. Int. Conf. Systems Theory: Modelling, Analysis and Control, Fes, 2009. Online: http://hal.inria.fr/inria-00352834/en/) in order to propose a model-free setting for delta hedging. It avoids most of the shortcomings encountered with the now classic Black-Scholes-Merton framework. Several convincing computer simulations are presented. Some of them are dealing with abrupt changes, i.e., jumps.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)