Authors

Summary

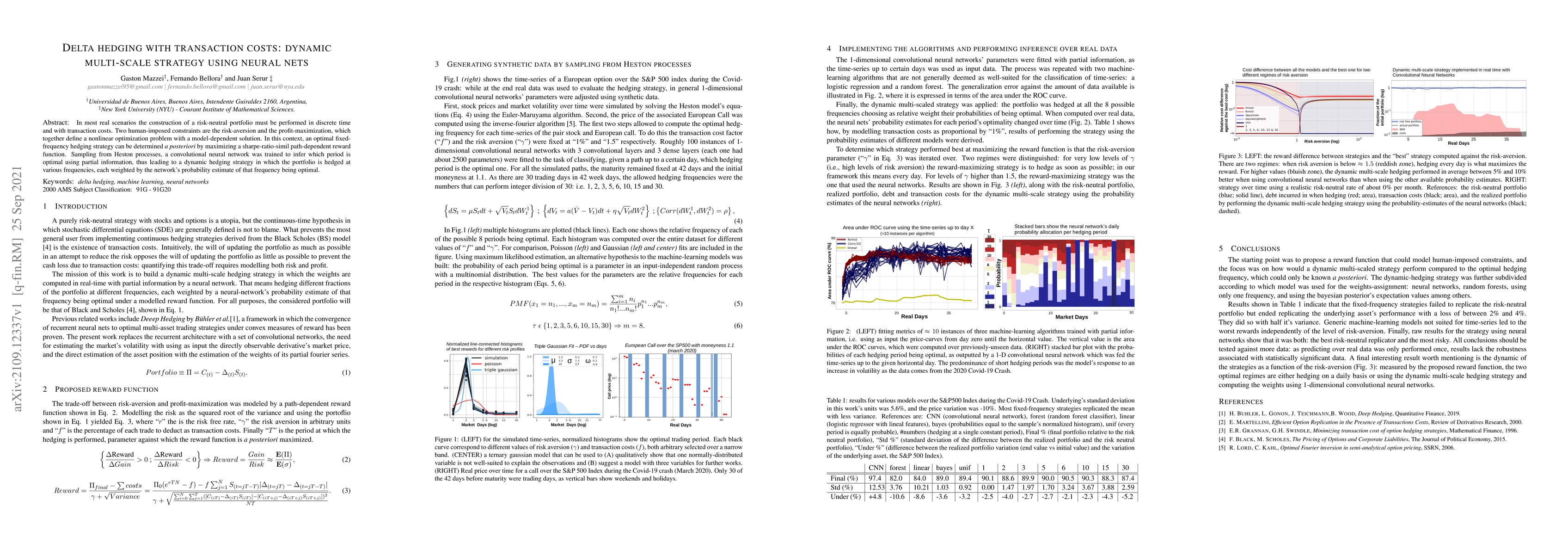

In most real scenarios the construction of a risk-neutral portfolio must be performed in discrete time and with transaction costs. Two human imposed constraints are the risk-aversion and the profit maximization, which together define a nonlinear optimization problem with a model-dependent solution. In this context, an optimal fixed frequency hedging strategy can be determined a posteriori by maximizing a sharpe ratio simil path dependent reward function. Sampling from Heston processes, a convolutional neural network was trained to infer which period is optimal using partial information, thus leading to a dynamic hedging strategy in which the portfolio is hedged at various frequencies, each weighted by the probability estimate of that frequency being optimal.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHedging in Jump Diffusion Model with Transaction Costs

Hamidreza Maleki Almani, Tommi Sottinen, Foad Shokrollahi

No citations found for this paper.

Comments (0)