Summary

We consider the class of valuations on indivisible items called gross-substitute (GS). This class was introduced by Kelso and Crawford (1982) and is widely used in studies of markets with indivisibilities. GS is a condition on the demand-flow in a specific scenario: some items become more expensive while other items retain their price. We prove that GS implies a much stronger condition, describing the demand-flow in the general scenario in which all prices may change. We prove that the demand of GS agents always flows (weakly) downwards, i.e, from items with higher price-increase to items with lower price-increase. We show that this property is equivalent to GS and is not true when there are complementarities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

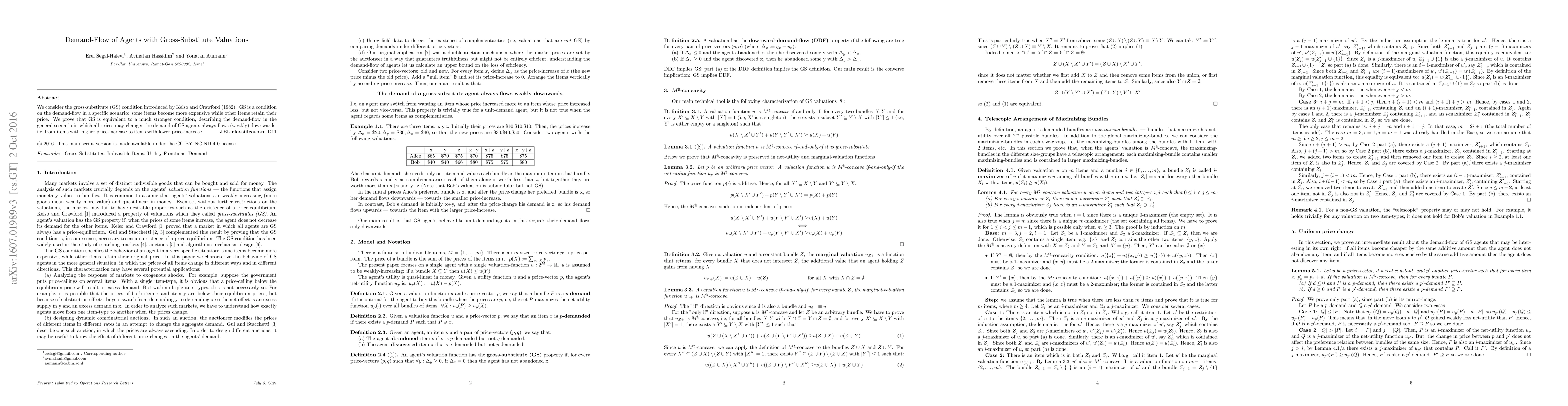

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAre Gross Substitutes a Substitute for Submodular Valuations?

Renato Paes Leme, Uriel Feige, Michal Feldman et al.

Auction Algorithms for Market Equilibrium with Weak Gross Substitute Demands

Jugal Garg, Edin Husić, László A. Végh

| Title | Authors | Year | Actions |

|---|

Comments (0)