Summary

In this paper we introduce a new technique based on high-dimensional Chebyshev Tensors that we call \emph{Orthogonal Chebyshev Sliding Technique}. We implemented this technique inside the systems of a tier-one bank, and used it to approximate Front Office pricing functions in order to reduce the substantial computational burden associated with the capital calculation as specified by FRTB IMA. In all cases, the computational burden reductions obtained were of more than $90\%$, while keeping high degrees of accuracy, the latter obtained as a result of the mathematical properties enjoyed by Chebyshev Tensors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

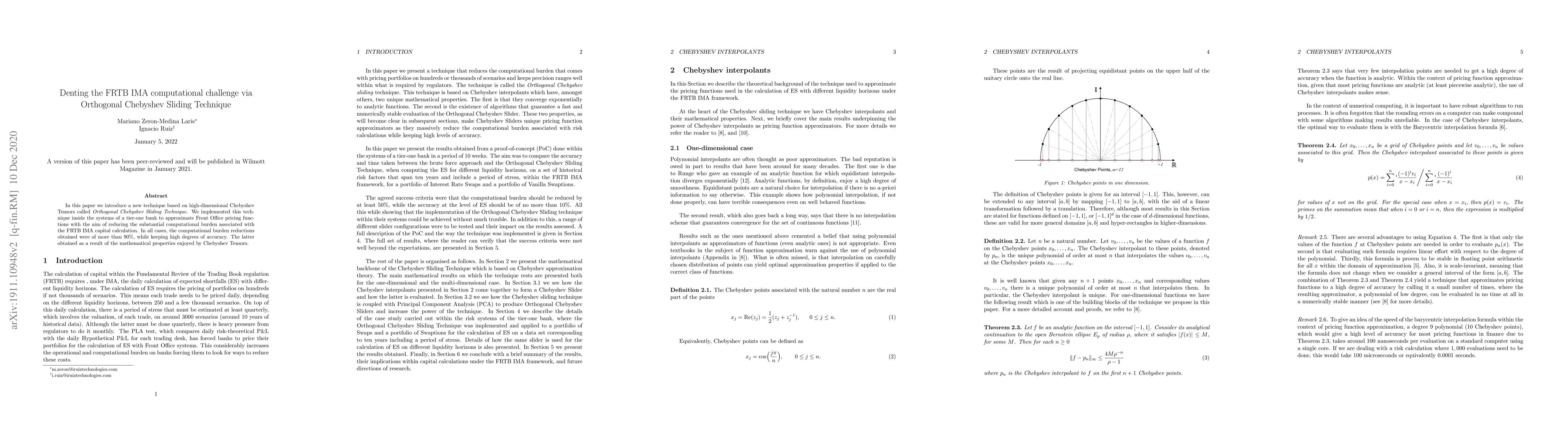

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe FRTB-IMA computational challenge for Equity Autocallables

Ignacio Ruiz, Meng Wu, Mariano Zeron

| Title | Authors | Year | Actions |

|---|

Comments (0)