Summary

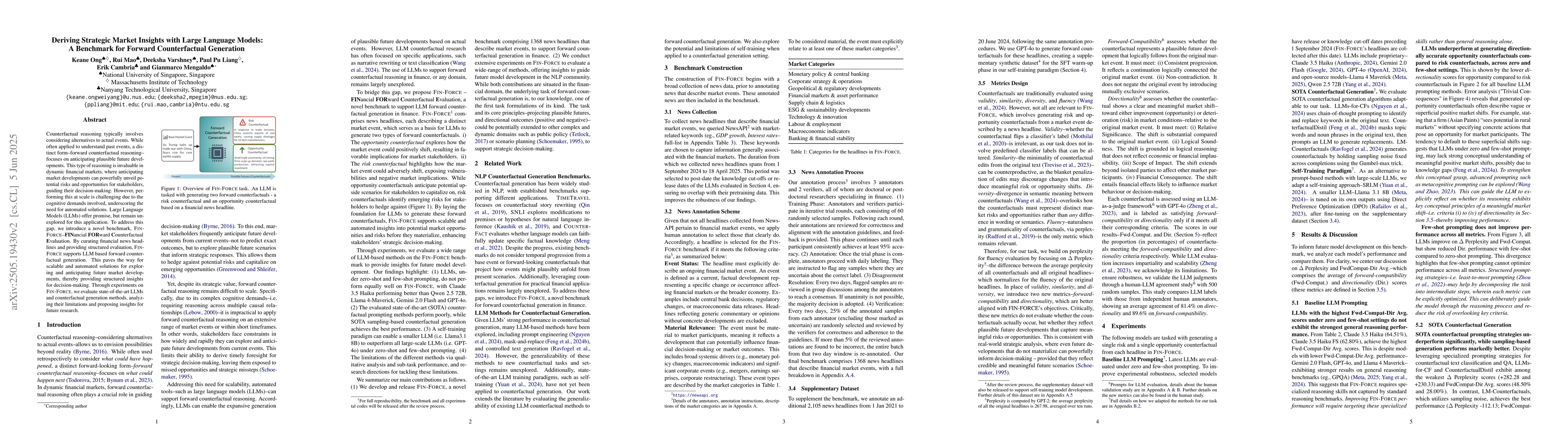

Counterfactual reasoning typically involves considering alternatives to actual events. While often applied to understand past events, a distinct form-forward counterfactual reasoning-focuses on anticipating plausible future developments. This type of reasoning is invaluable in dynamic financial markets, where anticipating market developments can powerfully unveil potential risks and opportunities for stakeholders, guiding their decision-making. However, performing this at scale is challenging due to the cognitive demands involved, underscoring the need for automated solutions. Large Language Models (LLMs) offer promise, but remain unexplored for this application. To address this gap, we introduce a novel benchmark, Fin-Force-FINancial FORward Counterfactual Evaluation. By curating financial news headlines and providing structured evaluation, Fin-Force supports LLM based forward counterfactual generation. This paves the way for scalable and automated solutions for exploring and anticipating future market developments, thereby providing structured insights for decision-making. Through experiments on Fin-Force, we evaluate state-of-the-art LLMs and counterfactual generation methods, analyzing their limitations and proposing insights for future research.

AI Key Findings

Generated Jun 07, 2025

Methodology

The research introduces a benchmark called Fin-Force-FINancial FORward Counterfactual Evaluation, curated from financial news headlines, to support LLM-based forward counterfactual generation for market insights.

Key Results

- Evaluation of state-of-the-art LLMs and counterfactual generation methods using Fin-Force benchmark.

- Identification of limitations in current LLMs for forward counterfactual generation in financial contexts.

Significance

This research is important as it aims to provide scalable and automated solutions for exploring and anticipating future market developments, thereby aiding decision-making processes for stakeholders in dynamic financial markets.

Technical Contribution

The creation of Fin-Force, a benchmark specifically designed for evaluating forward counterfactual generation using large language models in financial contexts.

Novelty

This work is novel by focusing on applying LLMs to forward counterfactual generation in financial markets, a previously unexplored domain, and by proposing a benchmark (Fin-Force) to facilitate this application.

Limitations

- Unexplored generalizability of LLMs to diverse financial scenarios beyond news headlines.

- Potential biases in LLM-generated counterfactuals stemming from training data.

Future Work

- Investigating LLM performance across a broader range of financial data types.

- Developing strategies to mitigate biases in generated counterfactuals.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCounterfactual Token Generation in Large Language Models

Eleni Straitouri, Manuel Gomez-Rodriguez, Ivi Chatzi et al.

WGSR-Bench: Wargame-based Game-theoretic Strategic Reasoning Benchmark for Large Language Models

Tong Wang, Jie Sun, Kaiqi Huang et al.

CLOMO: Counterfactual Logical Modification with Large Language Models

Wei Shao, Xiaodan Liang, Linqi Song et al.

CRASS: A Novel Data Set and Benchmark to Test Counterfactual Reasoning of Large Language Models

Jörg Frohberg, Frank Binder

No citations found for this paper.

Comments (0)