Authors

Summary

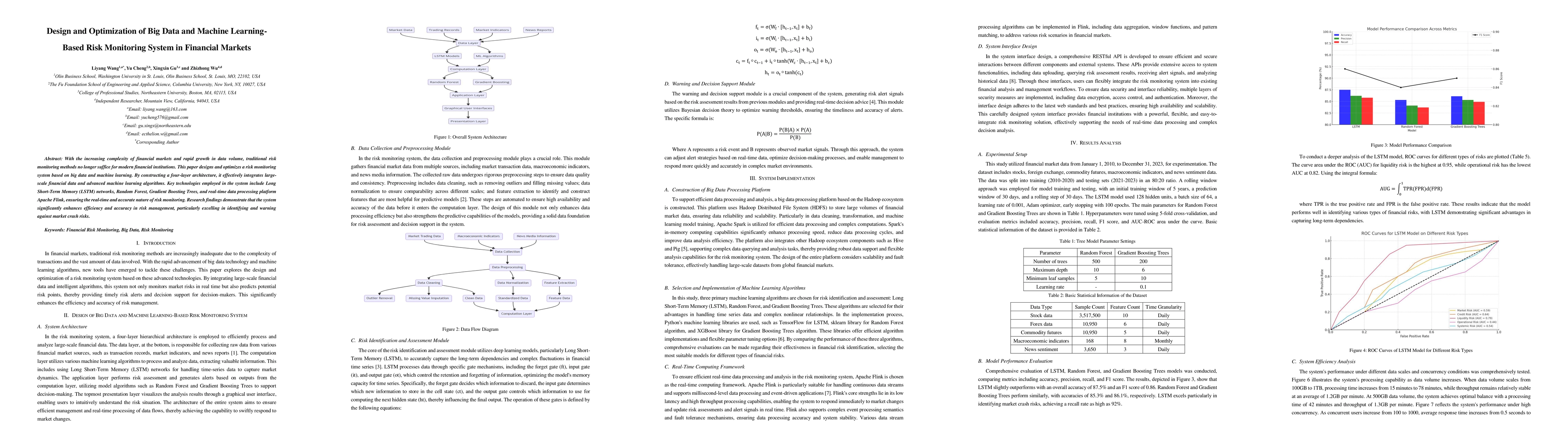

With the increasing complexity of financial markets and rapid growth in data volume, traditional risk monitoring methods no longer suffice for modern financial institutions. This paper designs and optimizes a risk monitoring system based on big data and machine learning. By constructing a four-layer architecture, it effectively integrates large-scale financial data and advanced machine learning algorithms. Key technologies employed in the system include Long Short-Term Memory (LSTM) networks, Random Forest, Gradient Boosting Trees, and real-time data processing platform Apache Flink, ensuring the real-time and accurate nature of risk monitoring. Research findings demonstrate that the system significantly enhances efficiency and accuracy in risk management, particularly excelling in identifying and warning against market crash risks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalysis of Financial Risk Behavior Prediction Using Deep Learning and Big Data Algorithms

Zhaoyang Zhang, Haowei Yang, Ao Xiang et al.

Research and Design of a Financial Intelligent Risk Control Platform Based on Big Data Analysis and Deep Machine Learning

Ziyue Wang, Shuochen Bi, Yufan Lian

Machine Learning based Enterprise Financial Audit Framework and High Risk Identification

Xi Zhang, Tingyu Yuan, Xuanjing Chen

| Title | Authors | Year | Actions |

|---|

Comments (0)