Summary

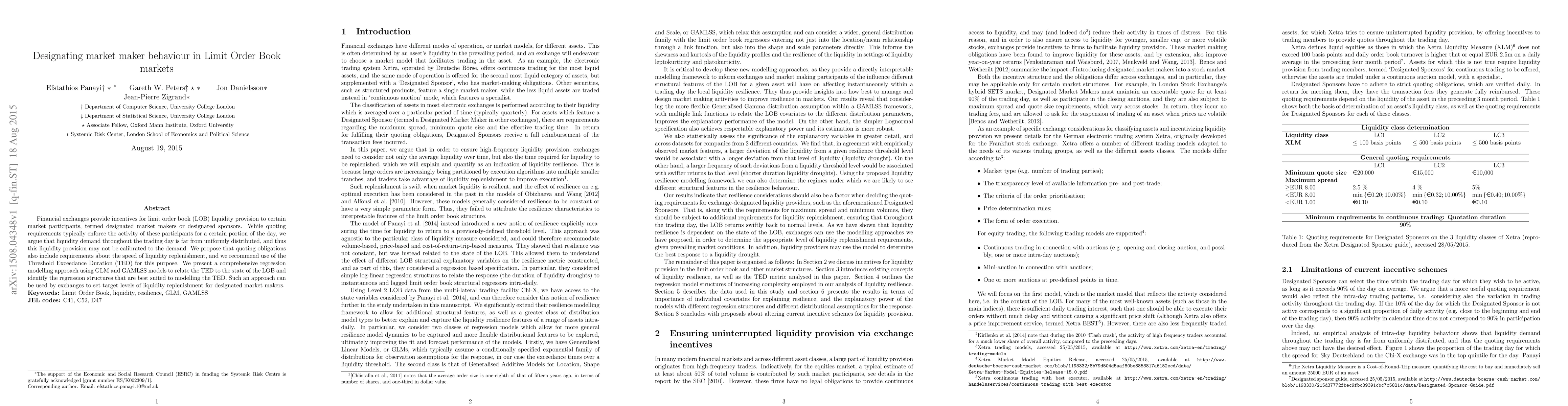

Financial exchanges provide incentives for limit order book (LOB) liquidity provision to certain market participants, termed designated market makers or designated sponsors. While quoting requirements typically enforce the activity of these participants for a certain portion of the day, we argue that liquidity demand throughout the trading day is far from uniformly distributed, and thus this liquidity provision may not be calibrated to the demand. We propose that quoting obligations also include requirements about the speed of liquidity replenishment, and we recommend use of the Threshold Exceedance Duration (TED) for this purpose. We present a comprehensive regression modelling approach using GLM and GAMLSS models to relate the TED to the state of the LOB and identify the regression structures that are best suited to modelling the TED. Such an approach can be used by exchanges to set target levels of liquidity replenishment for designated market makers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEquilibria in Network Constrained Markets with Market Maker

Giacomo Como, Leonardo Massai, Fabio Fagnani et al.

Looking into informal currency markets as Limit Order Books: impact of market makers

Roberto Mulet, Alejandro García Figal, Alejandro Lage Castellanos

| Title | Authors | Year | Actions |

|---|

Comments (0)