Summary

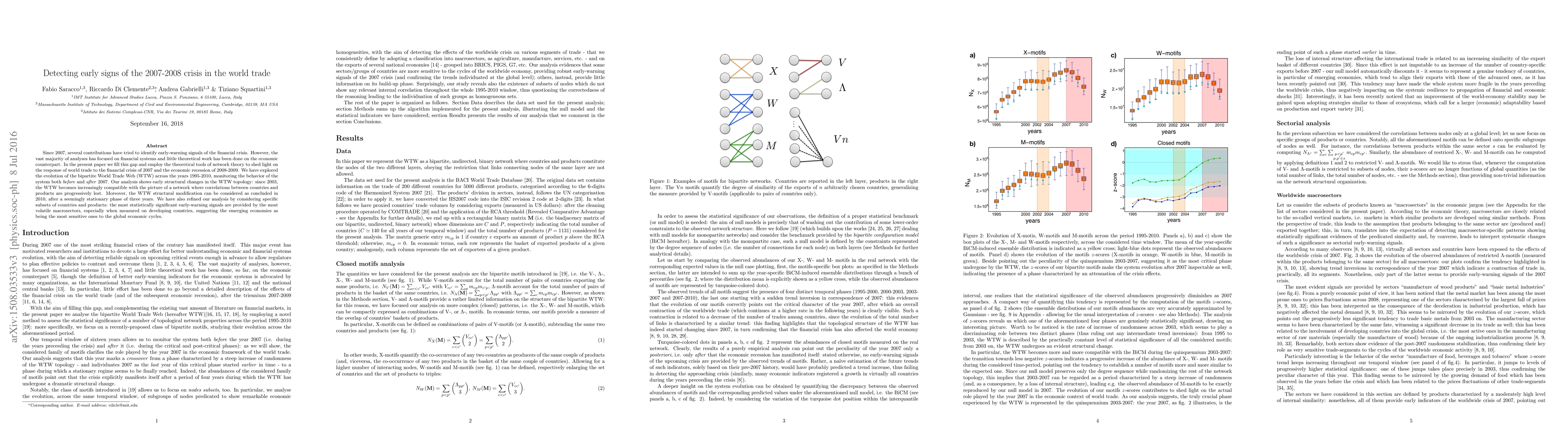

Since 2007, several contributions have tried to identify early-warning signals of the financial crisis. However, the vast majority of analyses has focused on financial systems and little theoretical work has been done on the economic counterpart. In the present paper we fill this gap and employ the theoretical tools of network theory to shed light on the response of world trade to the financial crisis of 2007 and the economic recession of 2008-2009. We have explored the evolution of the bipartite World Trade Web (WTW) across the years 1995-2010, monitoring the behavior of the system both before and after 2007. Our analysis shows early structural changes in the WTW topology: since 2003, the WTW becomes increasingly compatible with the picture of a network where correlations between countries and products are progressively lost. Moreover, the WTW structural modification can be considered as concluded in 2010, after a seemingly stationary phase of three years. We have also refined our analysis by considering specific subsets of countries and products: the most statistically significant early-warning signals are provided by the most volatile macrosectors, especially when measured on developing countries, suggesting the emerging economies as being the most sensitive ones to the global economic cycles.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)