Summary

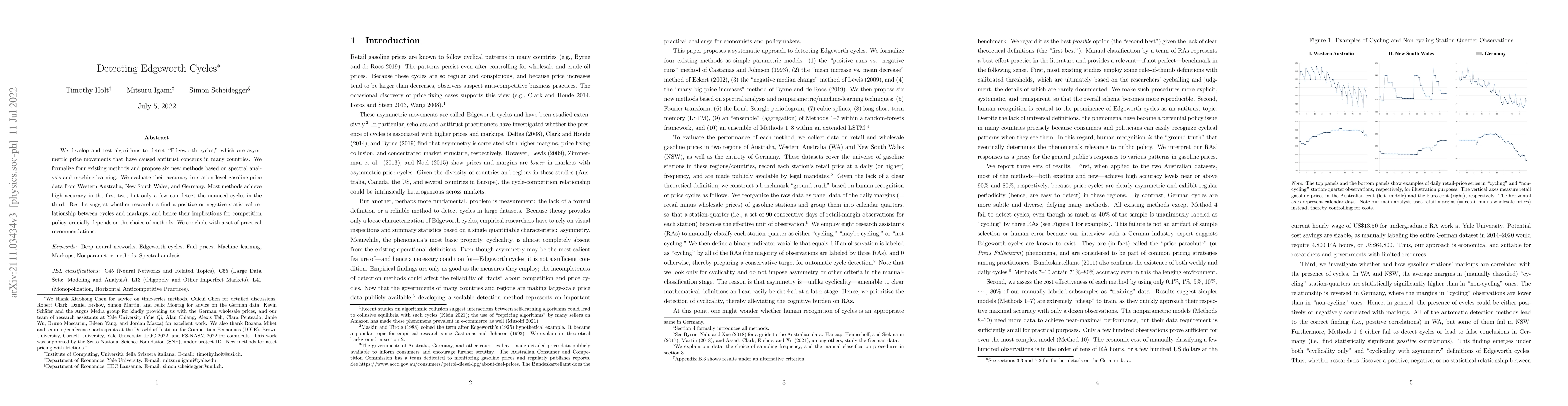

We develop and test algorithms to detect "Edgeworth cycles," which are asymmetric price movements that have caused antitrust concerns in many countries. We formalize four existing methods and propose six new methods based on spectral analysis and machine learning. We evaluate their accuracy in station-level gasoline-price data from Western Australia, New South Wales, and Germany. Most methods achieve high accuracy in the first two, but only a few can detect the nuanced cycles in the third. Results suggest whether researchers find a positive or negative statistical relationship between cycles and markups, and hence their implications for competition policy, crucially depends on the choice of methods. We conclude with a set of practical recommendations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)