Summary

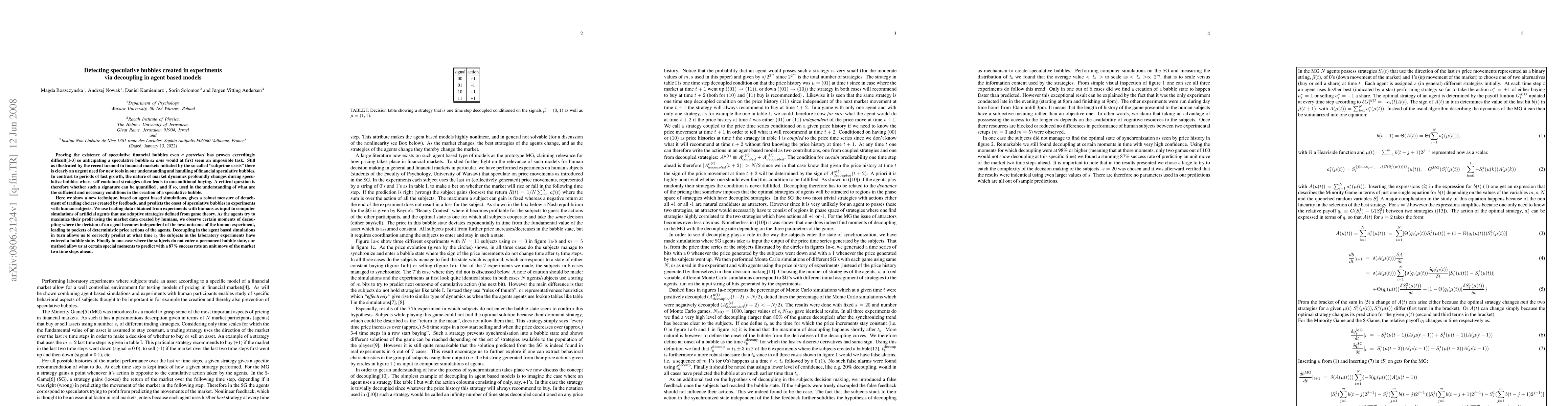

Proving the existence of speculative financial bubbles even a posteriori has proven exceedingly difficult so anticipating a speculative bubble ex ante would at first seem an impossible task. Still as illustrated by the recent turmoil in financial markets initiated by the so called subprime crisis there is clearly an urgent need for new tools in our understanding and handling of financial speculative bubbles. In contrast to periods of fast growth, the nature of market dynamics profoundly changes during speculative bubbles where self contained strategies often leads to unconditional buying. A critical question is therefore whether such a signature can be quantified, and if so, used in the understanding of what are the sufficient and necessary conditions in the creation of a speculative bubble. Here we show a new technique, based on agent based simulations, gives a robust measure of detachment of trading choices created by feedback, and predicts the onset of speculative bubbles in experiments with human subjects. We use trading data obtained from experiments with humans as input to computer simulations of artificial agents that use adaptive strategies defined from game theory....

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)