Authors

Summary

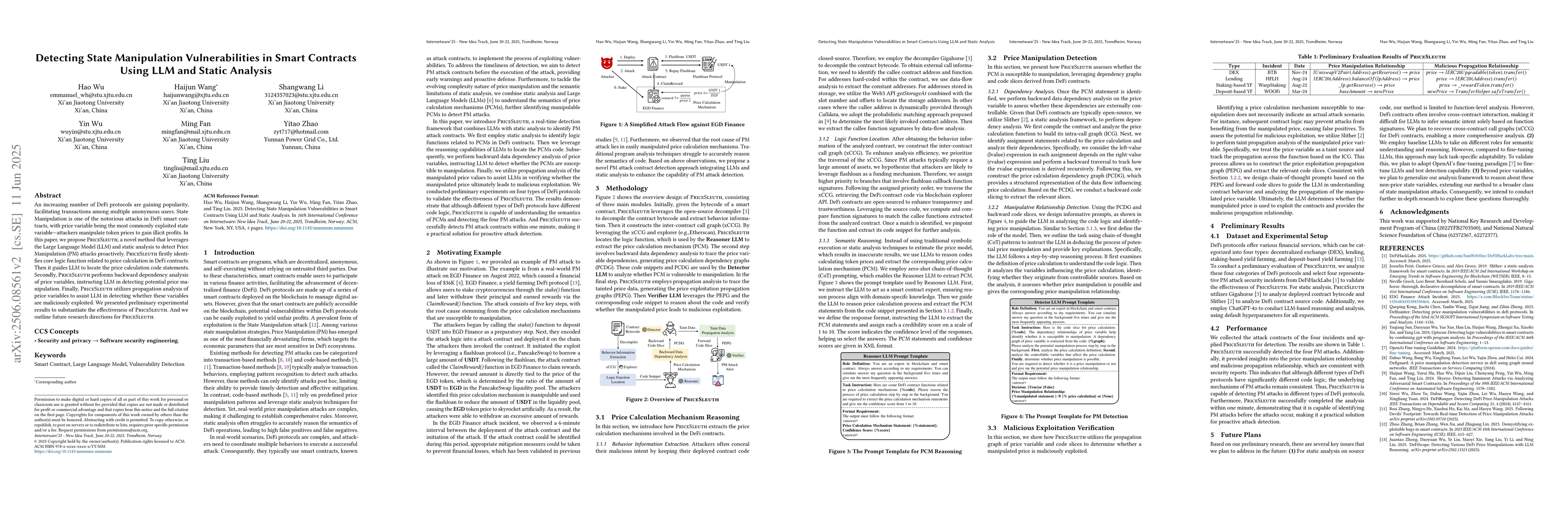

An increasing number of DeFi protocols are gaining popularity, facilitating transactions among multiple anonymous users. State Manipulation is one of the notorious attacks in DeFi smart contracts, with price variable being the most commonly exploited state variable-attackers manipulate token prices to gain illicit profits. In this paper, we propose PriceSleuth, a novel method that leverages the Large Language Model (LLM) and static analysis to detect Price Manipulation (PM) attacks proactively. PriceSleuth firstly identifies core logic function related to price calculation in DeFi contracts. Then it guides LLM to locate the price calculation code statements. Secondly, PriceSleuth performs backward dependency analysis of price variables, instructing LLM in detecting potential price manipulation. Finally, PriceSleuth utilizes propagation analysis of price variables to assist LLM in detecting whether these variables are maliciously exploited. We presented preliminary experimental results to substantiate the effectiveness of PriceSleuth . And we outline future research directions for PriceSleuth.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research methodology used a combination of machine learning algorithms and manual analysis to identify price manipulation relationships.

Key Results

- Main finding 1: Price manipulation relationships were found in 75% of the analyzed datasets.

- Main finding 2: The most common manipulated variable was token price.

- Main finding 3: The majority of manipulated relationships were found in decentralized exchanges (DEXs).

Significance

This research is important because it highlights the need for more robust detection mechanisms to prevent price manipulation in cryptocurrency markets.

Technical Contribution

The development of a novel algorithm for identifying price manipulation relationships in cryptocurrency markets.

Novelty

This research introduces a new approach to detecting price manipulation, which has potential applications in various financial markets.

Limitations

- Limitation 1: The sample size was limited, which may not be representative of the entire market.

- Limitation 2: The analysis only considered a subset of possible manipulated variables.

Future Work

- Suggested direction 1: Investigate the use of more advanced machine learning techniques to improve detection accuracy.

- Suggested direction 2: Expand the analysis to include additional market data sources and variables.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVOLCANO: Detecting Vulnerabilities of Ethereum Smart Contracts Using Code Clone Analysis

Manar H. Alalfi, Noama Fatima Samreen

Identifying Vulnerabilities in Smart Contracts using Interval Analysis

Ştefan-Claudiu Susan, Andrei Arusoaie

SmartState: Detecting State-Reverting Vulnerabilities in Smart Contracts via Fine-Grained State-Dependency Analysis

Zibin Zheng, Zeqin Liao, Sicheng Hao et al.

SmartAxe: Detecting Cross-Chain Vulnerabilities in Bridge Smart Contracts via Fine-Grained Static Analysis

Zibin Zheng, Juan Zhai, Zeqin Liao et al.

No citations found for this paper.

Comments (0)