Summary

To produce important investment decisions, investors require financial records and economic information. However, most companies manipulate investors and financial institutions by inflating their financial statements. Fraudulent Financial Activities exist in any monetary or financial transaction scenario, whether physical or electronic. A challenging problem that arises in this domain is the issue that affects and troubles individuals and institutions. This problem has attracted more attention in the field in part owing to the prevalence of financial fraud and the paucity of previous research. For this purpose, in this study, the main approach to solve this problem, an anomaly detection-based approach based on a combination of feature selection based on squirrel optimization pattern and classification methods have been used. The aim is to develop this method to provide a model for detecting anomalies in financial statements using a combination of selected features with the nearest neighbor classifications, neural networks, support vector machine, and Bayesian. Anomaly samples are then analyzed and compared to recommended techniques using assessment criteria. Squirrel optimization's meta-exploratory capability, along with the approach's ability to identify abnormalities in financial data, has been shown to be effective in implementing the suggested strategy. They discovered fake financial statements because of their expertise.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

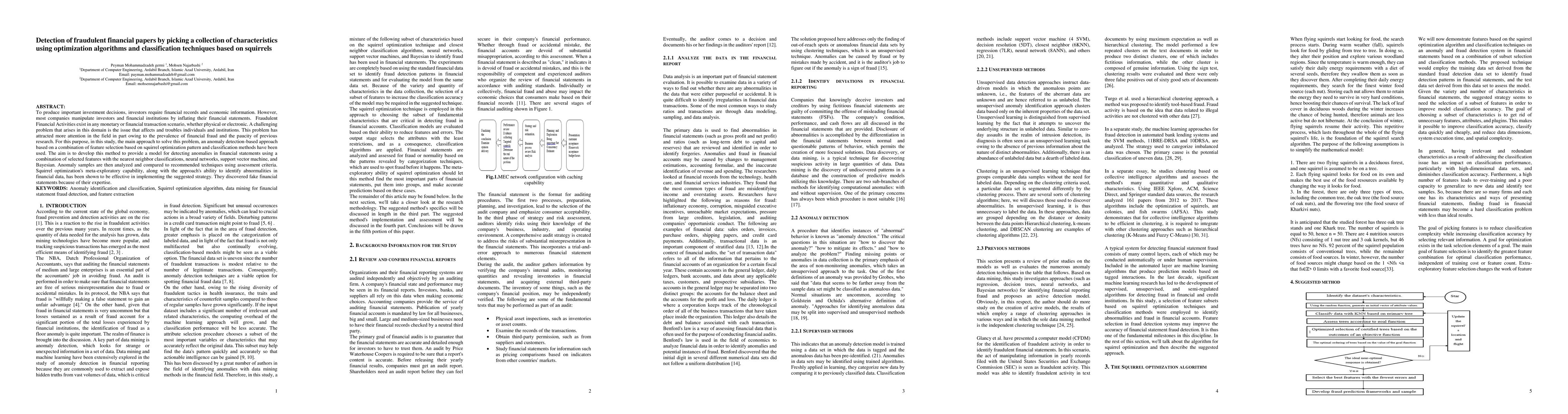

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)