Summary

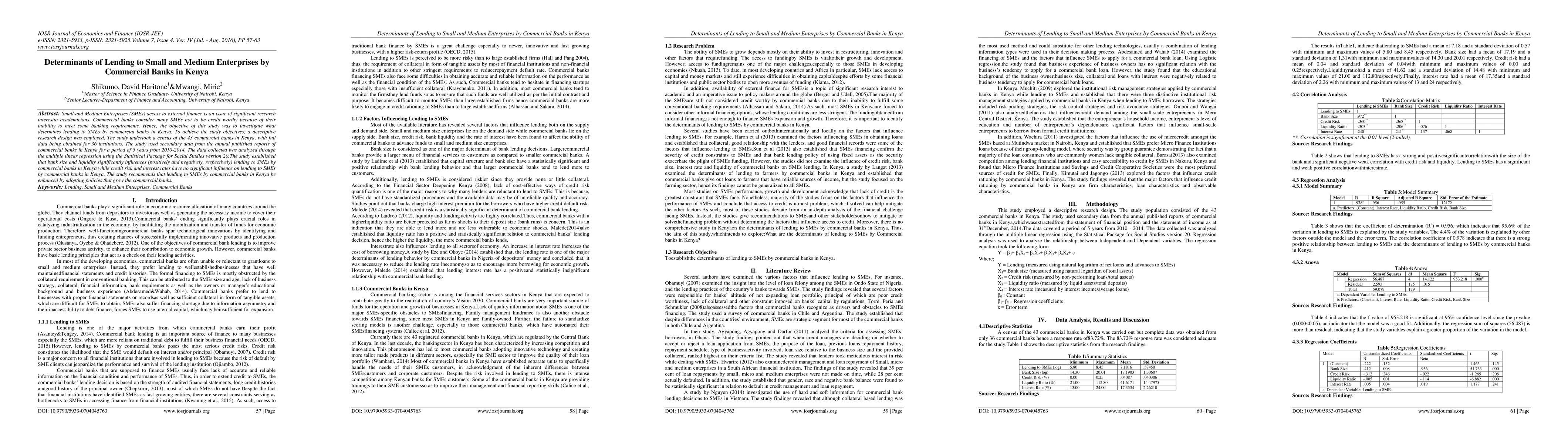

Small and Medium Enterprises (SMEs) access to external finance is an issue of significant research interest to academicians. Commercial banks consider many SMEs not to be credit worthy because of their inability to meet some banking requirements. Hence, the objective of this study was to investigate what determines lending to SMEs by commercial banks in Kenya. To achieve the study objectives, a descriptive research design was employed. The study undertook a census of the 43 commercial banks in Kenya, with full data being obtained for 36 institutions. The study used secondary data from the annual published reports of commercial banks in Kenya for a period of 5 years from 2010-2014. The data collected was analyzed through the multiple linear regression using the Statistical Package for Social Studies version 20.The study established that bank size and liquidity significantly influences (positively and negatively, respectively) lending to SMEs by commercial banks in Kenya while credit risk and interest rates have no significant influence on lending to SMEs by commercial banks in Kenya. The study recommends that lending to SMEs by commercial banks in Kenya be enhanced by adopting policies that grow the commercial banks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom banks to DeFi: the evolution of the lending market

Jiahua Xu, Nikhil Vadgama

| Title | Authors | Year | Actions |

|---|

Comments (0)